Cheap Auto Insurance in Norwalk, CT

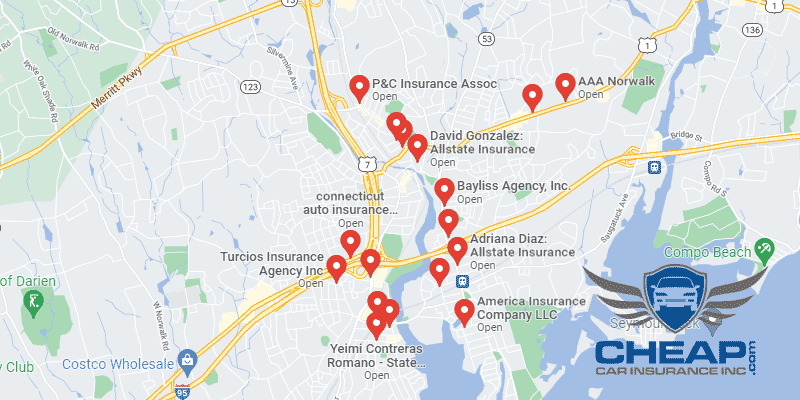

Are you needing cheap auto insurance in Norwalk, CT? At CheapCarInsuranceinc.com, we can help you find it. What you need to do is insert your local zip code in the quote box below – it’s that simple!

Norwalk, which was derived from the Algonquin name “noyank”, is the 6th most populous city in Connecticut and located in the state’s southwestern region. Also sometimes referred to as “Oyster Town”, this coastal city relies heavily on its oyster farming industry and even holds an annual Oyster Festival which draws in tourists from all over the country. Find more info on Connecticut car insurance here.

- Fun fact: Rosie the Riveter can eat her heart out, because Norwalk is #9 on the list of “Top 50 cities with greatest precentage of females working in industry: Machinery (population 50,000+)”. Learn more about Norwalk by clicking here.

Coverage Requirements - Auto Insurance in Norwalk Connecticut

Driving legally in Norwalk requires:

| Coverage | Requirements | Most Common |

| Liability Bodily Injury | 20,000/40,000 | 100,000/300,000 |

| Liability Property Damage | 10,000 | 50,000 |

| Bodily Injury - Motorist Uninsured | Not required | 20,000/40,000 |

| Not required Coverage | Medical Payments Coverage | 5,000 |

| Collision Coverage | Not required Coverage | 700 Insurance deductible |

| Comprehensive | Not required | 0 deductible |

Like a number of other states, all that you should need in order to drive legally in Connecticut is a modest Liability policy. But a renters insurance policy only pays out when the damage or accident under consideration was considered your fault. And when the entire cost is greater than the policy you’ve bought, then you will result in the main difference.

It is going to cost most Connecticut motorists around $137 every month to keep insurance on their own vehicle. However, Norwalk motorists could possibly get covered at this time for less than $64/mo*! Keep studying, and we’ll demonstrate how to get it done.

Between Nationwide and Amica, it’s harder to locate a lower rate per month. But reduced rates aren’t everything. Quality customer support and simple claims filing are also found in the entire insurance provider package.

Those that provide you with automobile insurance plans consider various elements while determining quotes, such as how long you’ve been driving, whether or not you’ve received any driving violations, what type of car or truck you own, driving distance to work, and theft protection devices. Also remember that premiums can alter from company to company. To ensure that you’re still receiving the best price, do a comparison of cheap Norwalk vehicle insurance rates over the internet.

Most Car Insurance Facts to know in Norwalk CT

The moment your motor vehicle insurance agency sits down to create your policy, they take numerous elements into mind. Many of these, just like your age or your particular location, are generally extremely hard to vary. A few alternative variables are:

- Your Zip Code

The area in which you drive the most will have the greatest impact on your overall insurance costs. Generally, vehicle insurance is cheaper in outlying locations because a lesser number of vehicles indicates a smaller possibility that you will get into an accident with another car. The populace of Norwalk is 87,776 plus the usual family earnings are $80,382.

- Automobile Accidents

For having such a large population, there aren’t very many significant accidents in Norwalk each year. And this is good news (not just for the obvious reasons). Driving in a town with safe roads will likely net you bigger insurance discounts from your provider.

- Car Thieving in Norwalk

Purchasing cheap automobile insurance can often be confusing if your automobile is a likely target of theft. The more popular the make/model of your care is, the more likely it is to be stolen, as well as vehicles which tend to be parked frequently in large urban centers. The total quantity of thieved cars in 2013 dropped down to 106 for the city of Norwalk. And while this means that Comprehensive coverage isn’t necessarily needed for theft protection, there are other reasons to invest in comprehensive coverage.

- Your Credit Score

It might surprise you to definitely discover your credit rating plays a significant role in figuring out your monthly insurance costs. This is also true for those who have an undesirable score. Some companies ask you for two times more like a driver with perfect credit. Others, for example Allstate, are a bit more forgiving.

- Your Age

The improved rates for youthful motorists can appear staggering. Within the chart below, for instance, Maqui berry farmers would charge a teenage driver ten occasions around a grownup with increased driving experience. However, many providers will offer you savings permanently students and youthful individuals who take driving courses. Ask the local agent for more information.

- Your Driving Record

For those who have significant driving offenses in your record, you risk having to pay much greater payments – or losing your coverage entirely. However, many providers nowadays are providing savings by means of “Accident Forgiveness” discount rates.

- Your Vehicle

If you wish to drive an costly vehicle, you will need to spend a substantial slice of money to help keep it insured. If tips over for your vehicle and also you haven’t bought enough coverage to pay for the expense, then you will be having to pay that difference.

Minor Car Insurance elements in Norwalk

However if you simply can’t change the major elements above, you may think about the following:

- Your Marital Status

Do you want use of some significant discount rates? Well, then you need to most likely get wed. When married people bundle together underneath the same company, they frequently get compensated with great savings. But when you are single, you may still bundle multiple guidelines together and save too – in case your provider offers multiple coverages, that’s.

- Your Gender

Regardless of what you may think, most insurance providers aren’t seeing a statistically factor in accidents between males and women. According to these details, many providers have stopped charging different rates according to gender.

- Your Driving Distance to Work

Most traffic in Norwalk isn’t too bad, especially when compared to other northeastern cities. Average commute times only last about 10 or 15 minutes, with the occasional trip lasing up to 20 minutes. Less than 75% of residents depend on their own vehicle for transportation, and 9% may carpool on any given day.

Bending over backwards to take down yearly mileage will not yield the discount rates that many people think it’ll. At the best, you may decrease your premium by 4-6%, and that is for any drastic cut of 5,000 or even more. And then try to keep the vehicle for private use only, because business vehicles will definitely cost 10% more to pay for.

- Your Coverage and Deductibles

Altering your deductible is among the most flexible methods to change your payment per month. Raising it’ll decrease your premium, but doing this also runs the danger that you may have to pay for a lot of money when the worst transpires with your automobile.

- Education in Norwalk, CT

Norwalk is a fairly well educated city; more than a quarter of the population has successfully completed their high school studies, while another 21% have gone on to earn a bachelor’s degree. This is good news if you are a part of this higher education minority, because your insurance provider will likely be offering you lower rates!

There are plenty of possibilities to pursue a higher education if you live in Norwalk, whether you want to stay in the city or commute to nearby towns. For those who wish to keep their education local, they can look into the Norwalk Community College or the Norwalk Campus of Gibbs College. NCC offers associates degrees and certificates for interested students, and is the 2nds largest community college within the entire state.

You shouldn’t permit an undesirable insurance company to persuade you into getting a motor vehicle insurance policy that isn’t ideal for you. Sure, the amount of related information required in order to assess your personal risk profile could be overwhelming, however comparison web pages similar to this may help make things a lot easier. Just simply type in just a few specifics below, and we shall do the rest.

How We Conducted Our Car Insurance Analysis

Sources:

Connecticut Insurance Department

Connecticut Department of Banking – Financial Institutions Division

Department of Highway Safety and Motor Vehicles

Ready to Compare Rates? See How Much You Can Save