Cheap Auto Insurance in Hialeah, FL

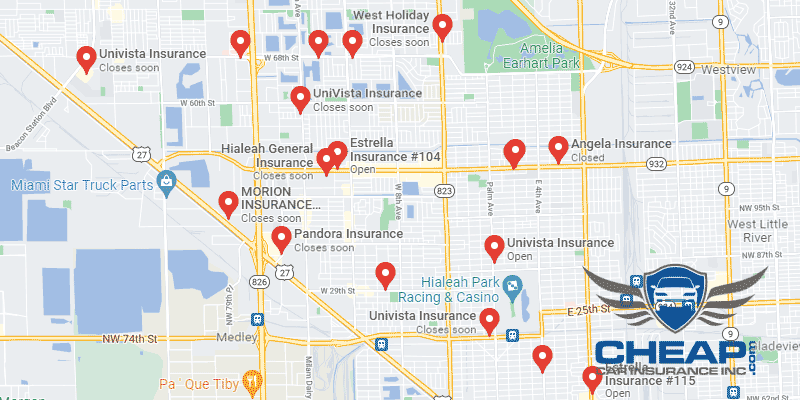

Seeking cheap auto insurance in Hialeah, FL? At CheapCarInsuranceinc.com, we can help you find it. What you need to do is input your local zip code in the quote box down below – it’s that simple!

The name for this city comes from a blend of Muskogee and Seminole words which mean “pretty upland prairie”. Indeed, the geography of Hialeah is that of a flat grassland located between the Florida Everglades and Biscayne Bay. This city also has one of the largest Cuban-American populations in the entire country.

- Fun fact: Get ready to shake, rattle, and roll…because Hialeah is #6 on the list of “Top 101 cities with the greatest earthquake activity (pop 50,000+)”. Read up on Hialeah by clicking here.

Coverage Requirements - Auto Insurance in Hialeah Florida

Driving legally in Hialeah requires:

| Coverage | Requirements | Most Common |

| Liability Bodily Injury | Not required | 100,000/300,000 |

| Liability Property Damage | 10,000 | 50,000 |

| Bodily Injury - Motorist Uninsured | Not required | 10,000/20,000 |

| Not required Coverage | Medical Payments Coverage | 5,000 |

| Collision Coverage | Not required Coverage | 700 Insurance deductible |

| Comprehensive | Not required | 250 deductible |

When thinking about what coverage to purchase, remember that state mandatory minimums are just suited to older, affordable vehicles which happen to be already paid off. In case your vehicle does not fit that description, you might like to purchase a more extensive policy to protect your vehicle from uninsured drivers, theft, or even flood damage.

Florida motorists, typically, are having to pay $153 or even more monthly simply to maintain their Automobile insurance plan. Hialeah citizens, however, could possibly get some good deals at this time. How would you like a 47%* or higher discount on your policy? Keep studying this page for more information.

It’s sometimes confusing to find cheap deals in Hialeah, but your lowest prices right now are coming from either Allstate or allied. However, beware those bargain prices – sometimes companies with poor customer service or financial standings use them to lure in business. But if you want to learn how to avoid them, just keep reading and discover new ways to save money on Florida auto insurance!

Companies which provide insurance coverage consider many elements when establishing insurance quotes, which includes gender, geography, your credit score, education, and theft protection devices. Additionally, premiums differ from company to company. To make sure that you’re still forking out the most affordable premium, examine cheap Hialeah vehicle insurance price quotes online.

Most Car Insurance Facts to know in Hialeah FL

You may feel slightly helpless once your vehicle insurance agency is evaluating your insurance quote; after all, a lot of the things that they calculate aren’t items you can easily alter or control. Luckily, however, there are a few things that you might be able to alter for increased discounts, including:

- Your Zip Code

The place you store your automobile each night will have a significant impact on your automobile insurance rate. Generally, automobile insurance is cheaper in rural regions because a lower number of vehicles means a smaller possibility that you will get in a accident with another car. The population of Hialeah is 233,394 plus the usual household earnings are $27,371.

- Automobile Accidents

You’re going to want to be extra careful driving around in a town with lots of accidents each year – the more Deadly and significant accidents there are in your area, the more likely your insurance company is to raise rates. But safe drivers can qualify for certain discounts.

- Car Thieving in Hialeah

Living in a big metropolis (chiefly any which has a substantial crime rate) increases your likelihood of becoming a victim for auto thieves. In cases where your general area has substantial rates of claims for theft, you are likely to pay more for your vehicle insurance in order to attempt to counter these prices. The actual complete number of stolen vehicles in 2013 dropped to 708 for Hialeah. This is remarkably low, considering the high rates of crime in the area. But that doesn’t mean you should cut corners in order to save money by giving up on your Comprehensive coverage.

- Your Credit Score

You ought to be worried about your credit rating for multiple reasons, including vehicle insurance. There are lots of providers available, including Amica and Liberty Mutual, who immensely raise payments for motorists with a bad credit score.

- Your Age

One factor which isn’t wasted around the youth are Automobile insurance costs. They have a tendency to operate high, and it’s not easy to locate an inexpensive payment per month. But receiving targeted grades and taking motorists education courses can help.

- Your Driving Record

Nobody is ideal that adage especially is applicable for your driving history. If your minute rates are irritatingly high as a result of speeding ticket or perhaps a minor accident, there’s hope. Ask your provider when they offer any “Accident Forgiveness” discount rates.

- Your Vehicle

The more recent and much more costly your automobile is, the greater coverage you can purchase to be able to safeguard it. Granted, in many areas it is not necessary legally to insure an extravagance vehicle by having an costly “Cadillac” insurance plan. However, if you buy inadequate coverage, and also the worst happens, you’ll be held financially responsible.

Minor Car Insurance elements in Hialeah

Be sure to try to control these elements too, for advanced savings:

- Your Marital Status

Are you and your partner bundled towards the same auto policy? Otherwise, then you need to certainly consider altering that status. Bundling together multiple insurance plans underneath the same company you can get some significant discount rates.

- Your Gender

Insurance providers can’t appear to create up their mind with regards to gender-based premiums. Many providers nowadays don’t even bother charging different prices whatsoever between genders. Of individuals who still do, should you ask five different companies which gender should pay more, you will probably get 6 different solutions.

- Your Driving Distance to Work

Despite Hialeah’s densely populated area, residents still have an average work commute of anywhere from 30-35 minutes each way. More than 76% of locals will make this trip in their own vehicle by themselves, while close to 20% may carpool on any given day.

Considering cutting your monthly premium by driving less? Well, you will for sure reduce gas and vehicle maintenance – but less on insurance charges. Even when you slash your yearly mileage through the 1000’s, you are only searching in a modest 4-5% discount.

- Your Coverage and Deductibles

If you want extra coverage, but posess zero large enough budget to cover it each month, try raising your deductible. It’s among the simplest and how to make certain you receive the policy you’ll need at most affordable cost.

- Education in Hialeah, FL

Most people might not be aware that one of the elements which automobile insurance companies base your premiums on is your level of education. To put it simple: the more education you have, the less you will have to pay. In Hialeah, 50% of residents have not yet completed their high school diploma, while 23% have successfully graduated or earned an equivalent degree.

Those searching for a higher education in Hialeah have a few local options. For potential students who want a public option, the Miami-Dade College has operated a satellite campus in Hialeah since the 1980’s. There are also two private schools, namely the Florida National College and the College of Business and Technology.

Motor vehicle insurance is likely one of the most significant financial investments you can possibly make as a car owner. You have to be sure to obtain a reputable, accountable vendor that will follow through on their promises. Certain automobile insurance agencies tend to be greater at this than the others, and doing a diligent internet based investigation can help you separate the favorable from the inferior.

How We Conducted Our Car Insurance Analysis

Sources:

Florida Office of Insurance Regulation

Florida Department of Financial Services

Department of Highway Safety and Motor Vehicles

Census.gov

Start comparing rates now. It will only take a minute or two, and you’ll save lots of money!