Cheap Auto Insurance in Lafayette, LA

Are you looking for cheap auto insurance in Lafayette, LA? At CheapCarInsuranceinc.com, you could find the very best insurance rates in your area. To get free car insurance quotes from the top rated providers today, type your zip code into the quote box on this page.

Lafayette is the fourth largest city within the state of Louisiana and comfortably nestled along the Vermilion River. When you think of the word “Cajun”, odds are you will also be thinking about Lafayette. The city has a rich Creole and Cajun history, and is a popular destination for foodies looking to try some authentic Cajun cuisine.

- Fun fact: Did you know that Lafayette is #8 on the list of “Top 101 zip codes with the largest percentage of Zairian first ancestries”?

Coverage Requirements - Auto Insurance in Lafayette Louisiana

Driving legally in Lafayette requires:

| Coverage | Requirements | Most Common |

| Liability Bodily Injury | 15,000/30,000 | 15,000/30,000 |

| Liability Property Damage | 25,000 | 25,000 |

| Bodily Injury - Motorist Uninsured | Not required | 10,000/20,000 |

| Medical Payments | Not required | 5,000 |

| Collision | Not required | 500 deductible |

| Comprehensive | Not required | 50 deductible |

Although the insurance requirements in Louisiana are lower than in other states, don’t let that fool you into thinking that an accident won’t cost you. Liability coverage doesn’t provide for every scenario; and even when it does, you may still have to pay if your coverage limits become exceeded.

The frighteningly high average rate for Louisiana drivers is somewhere around $164 per month, per driver. But you can save more than 50% in Lafayette if you follow our helpful advice. Right now, drivers in your area are forking out as low as $73/mo* for their coverage, and you can too.

Allstate, Nationwide, and the Southern Farm Bureau are offering some of the lowest rates around Lafayette. But does that low rate reflect their customer service? Or their claims processing? Sometimes, you get what you pay for. That includes quality of service.

Insurance carriers evaluate different elements when figuring out insurance quotes, including gender, where you live, credit score/rating, driving distance to work, and business use of the vehicle. In addition, premiums change from company to company. To verify you’re still being charged the most favorable rate, compare cheap Lafayette auto insurance quotes online.

Most Car Insurance Facts to know in Lafayette LA

There are numerous ways that your car insurance rate can be estimated. But not all of it is out of your control; there are actions you can take to be able to influence what discounts you are eligible to receive. Listed below are a few of these components in greater detail:

- Your Zip Code

Where you park your vehicle each night will have a significant impact on your auto insurance rate. Typically, car insurance is cheaper in rural areas because fewer cars means a reduced possibility that you will get into a wreck with another automobile. The population of Lafayette is 124,276 and the median household income is $47,784.

- Automobile Accidents

Areas with high rates of accidents, especially significant ones, can significantly raise your car insurance premiums. Take a look at the chart for Lafayette below. Those aren’t small numbers, especially considering the population of the city. Ask your provider if you qualify for any Safe Driver discounts to offset this.

- Car Thieving in Lafayette

Finding cheap auto insurance can be confusing if you are at risk for auto theft. Certain popular vehicle models are attractive to thieves, as well as vehicles which are parked often in large cities. 2013 marked a spike in stolen vehicles after a downward trend, bringing the number back up to 297. And, although Comprehensive coverage can be expensive, it’s the only way to protect your vehicle against auto theft.

- Your Credit Score

Having a bad credit score will negatively impact your life in many ways, and your monthly auto insurance premiums are just one of them. Some motorists are forking out double or more each month compared to people with flawless credit. Regrettably, the only way to fix this is to take on the arduous task of raising your credit score.

- Your Age

If you are a teenage driver, or the parent of one, than the chart below will be especially painful for you to look at. Younger drivers are charged wildly higher rates due to the fact that their lack of driving experience puts them at a higher risk for an accident. Luckily, there are Good Student and Driver’s Ed discounts available to help offset this cost.

- Your Driving Record

Having multiple tickets or significant violations (like a DUI, for example) will drastically raise your rates. Some companies may refuse to cover you altogether. However, some are willing to overlook a minor citation or two when you qualify for an Accident Forgiveness discount.

- Your Vehicle

It’s not so much the cost of a luxury vehicle which determines how expensive the insurance costs are. It’s the driver’s desire to protect their investment. You see, you can purchase less coverage in smaller amounts for any type of vehicle; but if something happens to it, most of the financial responsibility for repairs or replacement will likely be on you.

Minor Car Insurance elements in Lafayette

Of course, there are also these elements:

- Your Marital Status

Married couples don’t necessarily get lower rates just for being married – they can, however, get some significant discounts for bundling their policies together. And this goes for multiple types of insurance, not just auto policies.

- Your Gender

Most insurance companies don’t waste time with gender politics; they prefer to look at statistical data. And their data shows, for the most part, that there is no difference in the way most men and women drive. Therefore, many insurance companies are discontinuing the practice of charging different rates based on gender alone.

- Your Driving Distance to Work

The average commute time in Lafayette can last 14-30 minutes, but that mostly depends on what part of the city you live in. Between 8-19% of drivers will carpool any given day, but that number can get as low as 4% or as high as 25% in certain areas.

If possible, make sure your vehicle is insured for personal use (driving to work, school, or for recreational reasons). This is because business vehicles will cost around 10-11% more to insure. Also, feel free to drive as many miles as you need to. Trying to save money by limiting mileage will only net you a 2-3% discount, optimistically.

- Your Coverage and Deductibles

Thinking about raising or lowering your deductible? Your Deductible has an inverse relationship to your overall monthly premium. The higher the deductible, the lower your monthly bill (and vice versa). However, if you actually have to file a claim, that deductible is 100% your financial responsibility.

- Education in Lafayette, LA

For Lafayette, the largest percentage of drivers on the road have a full high school education or some other equivalent. And the college graduates aren’t far behind – more than 20% of residents have a bachelor’s degree. If you are one of the motorists living in Lafayette with a higher education, check with your insurance provider to see if they are willing to offer you a discounted rate. This one little factor is actually a bigger source of savings than your job, or your salary.

Lafayette offers a handful of choices for those wishing to pursue a higher education. The University of Louisiana has a campus in Lafayette, and is nationally recognized for its expertise in architecture, nursing, computer science, and biology. There is also the National EMS Academy for would-be EMTs. If you want a technical or vocational degree, you can look into the Louisiana Technical College or Remington College.

Regrettably for most insurance companies, a straightforward internet search can reveal many of their business secrets. But even with the right information, it can still be confusing for you as an individual to understand your risk profile and find low-cost insurance. Make sure you do your due diligence prior to committing to your next car insurance policy. Learn more about Lafayette, LA.

How We Conducted Our Car Insurance Analysis

Sources:

Louisiana Department of Insurance

Louisiana Office of Financial Institutions

Department of Highway Safety and Motor Vehicles

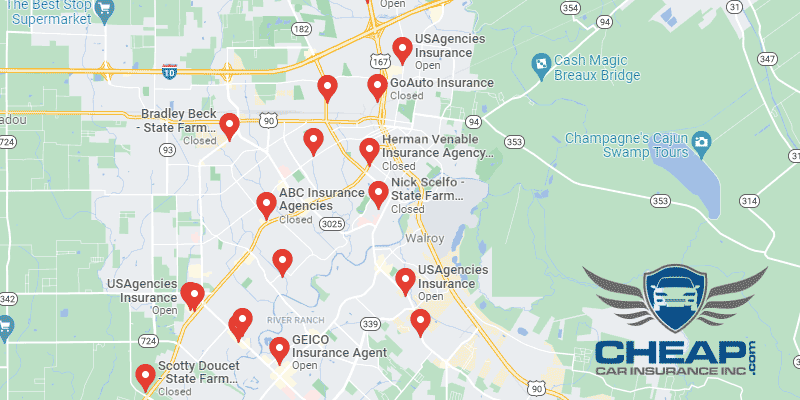

These Companies in Lafayette, LA Offer the Best Car Insurance Rates