Cheap Auto Insurance in Shreveport, LA

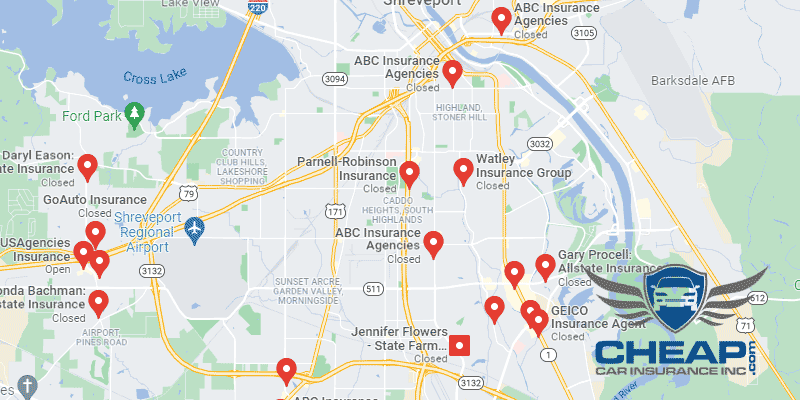

Are you looking for cheap auto insurance in Shreveport, LA? At CheapCarInsuranceinc.com, you’ll find the very best insurance rates near you. To acquire free car insurance quotes from the leading providers today, enter your zip code into the quote box on this page.

Shreveport is the third largest city in Louisiana and located along the Red River in the northwest corner of the state. Originally, the city was founded by the Shreve Town Company in the early part of the 1830’s as a commercial stopping point between the Republic of Texas and the eastern part of the United States. To this day, Shreveport is still a major hub for commerce and culture for the states of Arkansas, Louisiana, and Texas.

- Fun fact: Did you know that Shreveport is #35 on the list of “Top 100 cities with the largest percentage of females (pop. 50,000+)”?

Coverage Requirements - Auto Insurance in Shreveport Louisiana

Legally driving in Louisiana requires at least this much insurance coverage:

| Coverage | Requirements | Most Common |

| Liability Bodily Injury | 15,000/30,000 | 15,000/30,000 |

| Liability Property Damage | 25,000 | 25,000 |

| Bodily Injury - Motorist Uninsured | Not required | 10,000/20,000 |

| Medical Payments | Not required | 5,000 |

| Collision | Not required | 500 deductible |

| Comprehensive | Not required | 50 deductible |

Although the insurance requirements in Louisiana are lower than in other states, don’t let that fool you into thinking that an accident won’t cost you. Liability coverage doesn’t provide for every scenario; and even when it does, you may still have to pay if your coverage limits become exceeded.

The frighteningly high average rate for Louisiana drivers is somewhere around $164 per month, per driver. But you can save more than 50% in Shreveport if you follow our helpful advice. Right now, drivers in your area are forking out as low as $61/mo* for their coverage, and you can too.

Allstate, Nationwide, and the Southern Farm Bureau are offering some of the lowest rates around Shreveport. But does that low rate reflect their customer service? Or their claims processing? Sometimes, you get what you pay for. That includes quality of service.

Insurance carriers evaluate different elements when figuring out insurance quotes, including gender, where you live, credit score/rating, driving distance to work, and business use of the vehicle. In addition, premiums change from company to company. To verify you’re still being charged the most favorable rate, compare cheap Shreveport auto insurance quotes online.

Most Car Insurance Facts to know in Shreveport LA

There are numerous ways that your car insurance rate can be estimated. But not all of it is out of your control; there are actions you can take to be able to influence what discounts you are eligible to receive. Listed below are a few of these components in greater detail:

- Your Zip Code

Your auto insurance rates can vary depending on where you call home. In general, highly populated cities have higher car insurance rates because the additional number of drivers on the highway raises the likelihood of an accident! The population of Shreveport is 200,327 and the median household income is $35,772.

- Automobile Accidents

Shreveport experienced an Regrettably number of Deadly car accidents in 2013 alone, as the chart shows. However, there are over 200,000 people living in the area, which means per capita accident rates still could be fairly low. And the lower accident rates are in your area, the more you will save on your premiums each month.

- Car Thieving in Shreveport

Auto theft is a major problem, especially in densely populated cities. If your location and/or vehicle model put you at a greater risk for theft, you may have trouble finding low-cost car insurance. The total number of stolen vehicles in Shreveport was 504 back in 2013. Not only is this a drop in thefts from previous years, but the per capita theft rate is fairly low. It might be possible to reduce your monthly insurance bill by raising your Comprehensive coverage deductible.

- Your Credit Score

Take a look at the chart below. In most states, drivers with poor credit have to pay double or even triple what drivers with perfect credit do – and the problem is just as bad in Louisiana. Try tracking your credit score via a free monitoring site and take steps to raise your overall rating. Eventually, your efforts will yield car insurance discounts.

- Your Age

As you can see in this chart, Teenage motorists have an exceptionally tough financial stress when it comes to forking out insurance premiums. However, such high rates are usually charged while Teenage motorists are still in school. Because of this, there are Good Student and Driver’s Ed discounts which students can take advantage of.

- Your Driving Record

The newest trend in Automobile insurance discounts is “accident forgiveness” discounts. This discount helps lower your monthly premium if, for example, you only have a minor accident or other citation on your record. Your provider will “ignore” the infraction, and not use it when calculating your premiums.

- Your Vehicle

Luxury vehicles are more expensive to insure because they require a luxury insurance policy, plain and simple. You could actually insure an expensive, shiny luxury vehicle for quite cheaply if all you bought were low amounts of Liability coverage. But if anything else happened you your vehicle, you would be 100% financially responsible for replacing it.

Minor Car Insurance elements in Shreveport

Of course, there are also these elements:

- Your Marital Status

Are you currently bundling your auto policy (and other insurance policies) with your spouse? Well, you should start if you haven’t already. Married couples can bundle all sorts of different policies under one company, and get offered massive discounts as a result.

- Your Gender

Did you know that an increasing number of insurance companies are charging the exact same rates regardless of gender? You may believe that men and women are from different planets, but according to the data gathered on planet Earth, there is statistically no difference in driving risk between genders.

- Your Driving Distance to Work

When commuting to work in Shreveport, the average driver can expect to be behind the wheel for 15-27 minutes. Just over 75% of citizens drive their own car in to work by themselves, while another 8-17% carpool.

Reducing your mileage each year may seem like a great way to save money on insurance, but at best you’ll only be saving 3-4%, and you’ll have to shave thousands of miles off your odometer in order to achieve that. For real savings, stick to using your vehicle for personal use only. Business vehicles cost 11% more to insure, on average.

- Your Coverage and Deductibles

Deductibles are a great way to save money on your monthly premiums, if you’re not afraid to raise them. While doing so will lower your monthly payments, it will also leave you with a hefty bill should you need to file a claim. Therefore, make sure you have some money saved away before employing this strategy.

- Education in Shreveport, LA

If you live in Shreveport, you might want to think about furthering your education in order to save money on car insurance. Insurance providers have recently started offering lower rates to motorists with advanced degrees, regardless of your salary or chosen profession. Most drivers in Shreveport have a high school diploma (or some other equivalent), while many have yet to complete their high school education.

There are a variety of public and private options to choose from when seeking a higher education in Shreveport. Louisiana State University has a campus at Shreveport, as well as a center for the study of Health Sciences. Also in the medical field is the Northwestern State University College of Nursing. For a private option, you can look into Centenary College, a Methodist university, or SUSLA (Southern University, Shreveport) for an associate’s degree.

Finding reasonably priced auto insurance can be a hassle. There’s a lot of information you need to consider, and figuring out how insurance companies evaluate your potential risk can be challenging. But don’t let the wrong insurance company talk you into purchasing the wrong policy. Learn more about Shreveport, LA.

How We Conducted Our Car Insurance Analysis

Sources:

Louisiana Department of Insurance

Louisiana Office of Financial Institutions

Department of Highway Safety and Motor Vehicles

Compare Auto Insurance Rates in Shreveport, LA – See How Much You Can Save