Cheap Auto Insurance in Fresno, CA

In the market for auto insurance in Fresno? At CheapCarInsuranceinc.com, you can get the very best insurance rates close to you. To find free car insurance quotes from the top rated California auto insurance providers today, type your zip code into the quote box on this page.

Outside of California, few people realize that Fresno is known as the “agribusiness center of the world”. The city connects four different farming regions from across the US. There are also multiple national parks accessible via Fresno, including the famous Yosemite National Park.

- Fun fact: Did you know that Fresno is #1 on the list of “Top 101 cities with the largest humidity differences during a year”? Learn more about Fresno, CA.

Coverage Requirements - Auto Insurance in Fresno California

Fresno residents who want to legally drive in California are required, by law, to purchase at least:

| Coverage | Requirements | Most Common |

| Liability Bodily Injury | 15,000/30,000 | 100,000/300,000 |

| Liability Property Damage | 5,000 | 100,000 |

| Bodily Injury - Motorist Uninsured | Not required | 20,000/40,000 |

| Not required Coverage | Medical Payments Coverage | 5,000 |

| Collision Coverage | Not required Coverage | 700 Insurance deductible |

| Comprehensive | Not required | 250 deductible |

When it comes to Automobile insurance, you obviously want the best coverage for the best deal. So you have to balance getting the coverage you need with your available funds. If you have the extra money, try getting a little more than just Liability coverage. It’ll come in handy in case severe weather or an uninsured motorist ever cause damage to your vehicle.

Car insurance in California can be expensive, with average drivers forking over $164 per month for coverage. Luckily for Fresno residents, you can get decent coverage for as low as $61/mo*. To find great discounts near you, keep reading.

As you can see in the chart, you can probably get the lowest rates from either Allstate, Nationwide, or Hartford. But don’t be fooled by a low monthly payment. Would it be worth it to you to pay a few dollars more if you knew that company had great customer service? Or the best claims service in the business?

Auto insurance carriers evaluate various elements when assessing insurance quotes, including driving violations, accident claims, occupation, years of driving experience, and theft protection devices. Also keep in mind that premiums vary from provider to provider. To make sure you’re still being charged the most favorable rate, compare cheap Fresno auto insurance quotes online.

Most Car Insurance Facts to know in Fresno CA

Insurance companies take multiple elements into account when crafting an auto insurance policy. Regrettably, many of these elements are confusing or impossible to change, such as your credit score or the make/model of your car. Other elements your car insurance company may consider include:

- Your Zip code

The cheapest car insurance is usually found in cities with a lower population density. Because there are fewer vehicles on the road, there are fewer possibilities for you to get into a major car accident with another driver. The population of Fresno is 509,924 and the median household income is $40,179.

- Automobile Accidents

Whenever you have frequent accidents in a given area, you will also see higher automobile insurance rates, because of the extra inherent danger associated with driving in that area. For the most part, it looks as though the Deadly accident statistics for Fresno have been decreasing in recent years.

- Car Thieving in Fresno

Living in a large city (Especially one with a high crime rate) will increase your risk of being a victim of auto theft. If your general location has high rates of theft and claims, you can expect to pay more for auto insurance to offset these costs. The total number of stolen vehicles in Fresno was 4,057 back in 2013. Although this reflects a decrease over recent years, you still might want to think about adding theft protection (i.e. Comprehensive Coverage) to your policy.

- Your Credit Score

Luckily for Californians with low credit scores, your state is one of three in the country where it is illegal for Automobile insurance companies to charge different rates based on credit scores. However, be prepared to pay just a little bit extra; it is likely that your provider will charge everyone a slightly higher rate to offset their financial risk.

- Your Age

Teenage motorists face a especially harrowing stress when forking out for their first auto insurance policy. Because of their inexperience, they are immensely more likely to get into a significant accident. That’s why some companies charge them 2x-3x higher premiums than someone twice their age.

- Your Driving Record

Do you have a slightly imperfect driving record? Then you might be able to benefit from an “Accident Forgiveness” discount program. Accident Forgiveness can save you money if your provider is willing to ignore minor marks on your record, such as a speeding ticket or a minor accident. More significant violations, however, are harder to negotiate.

- Your Vehicle

The more expensive your vehicle is, the more it will cost to insure. After all, would you trust a luxury vehicle to an auto policy with only the state minimum amount of coverage? Probably not. If you’re going to make a big, luxurious vehicle purchase, make sure you have the money to keep it comprehensively insured.

Minor Car Insurance elements in Fresno

You might not think much of the following attributes, but they can influence your rates too (in smaller ways):

- Your Marital Status

Married couples have an advantage when it comes to auto insurance – bundled discounts. By bundling your insurance policy with your spouse, you can both save on your premiums each month. The only catch is that you have to bundle with the same company.

- Your Gender

Regardless of past misconceptions, the idea that one gender is safer behind the wheel than the other (and therefore deserves to pay less in premiums) is slowly fading away. Many companies don’t charge different premiums at all if gender is the only factor in question. For those that do, it rarely makes more than a 1-2% difference.

- Your Driving Distance to Work

If you work in Fresno, you can expect a commute time of around 15-25 minutes per trip. Nearly 75% of residents prefer to drive their own car to work, while anywhere from 5-18% may carpool on a given day.

Limiting your yearly mileage will certainly save you money on gas and reduce your chances of an accident, but it won’t help much for reducing your monthly premium. Even if you drive fewer miles than average, you’ll only reduce your rate by 2-3% at best. But if you can, avoid insuring your car, truck, or SUV as a business vehicle. That classification can cost you 10% or more in rate hikes.

- Your Coverage and Deductibles

If you don’t have a big budget for your insurance premiums, try raising your deductible. The higher your deductible, the lower your monthly premiums will be. This means that you can get a basic auto policy for a immensely reduced rate, or somewhat better coverage for a relatively affordable monthly premium.

- Your Education

Partly because Fresno has such a young population, many drivers have not yet finished their high school education. Others have a high school diploma or some equivalent. But did you know that having a higher education can save you money on your car insurance rates? That’s right; forget having a fancy job or a high salary. It’s your overall education level that gets you the biggest Automobile insurance discounts.

Getting a degree in Fresno is easier than you might think. California State University has a local campus there, offering degrees in more than 100 different subjects, and it even has its own University Farm. Additionally, Fresno City College offers Associates degrees in scores of different subjects.

Determining your individual financial risk can be very confusing or impossible for the typical insurance shopper. Insurance companies have an advantage over consumers due to their statistics and experiential knowledge. Learn what insurance companies don’t want you to know.

How We Conducted Our Car Insurance Analysis

Sources:

California Department of Insurance

California Division of Financial Institutions

Department of Highway Safety and Motor Vehicles

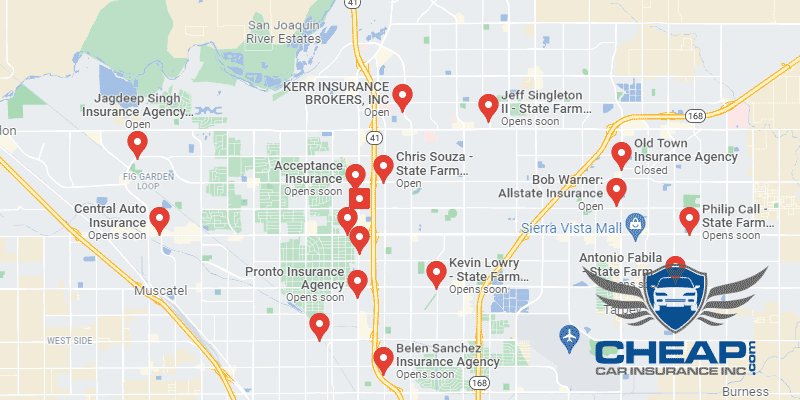

These Companies Offer Lowest Rates on Auto Insurance in Fresno, CA