Cheap Auto Insurance in Sacramento, CA

Want cheap auto insurance in Sacramento, CA? CheapCarInsuranceinc.com can help you find what you need. What you need to do is enter your zip code in the quote widget down below – it’s that simple!

Sacramento is the capital city of California with an interesting history. It started out as a major boom town during the gold rush era, and eventually evolved into an agricultural center. Today, the city produces a significant portion of the food that the rest of the country eats, and it also has an ideal climate for growing Camellia flowers.

- Fun fact: make sure to wear your sunscreen, because Sacramento is #2 on the list of “Top 101 cities with the highest maximum monthly sunshine amount (population 50,000+)”. Learn more about Sacramento by clicking here.

Coverage Requirements - Auto Insurance in Sacramento California

Driving legally in Sacramento requires:

| Coverage | Requirements | Most Common |

| Liability Bodily Injury | 15,000/30,000 | 100,000/300,000 |

| Liability Property Damage | 5,000 | 100,000 |

| Bodily Injury - Motorist Uninsured | Not required | 20,000/40,000 |

| Not required Coverage | Medical Payments Coverage | 5,000 |

| Collision Coverage | Not required Coverage | 700 Insurance deductible |

| Comprehensive | Not required | 250 deductible |

California’s minimum Liability needs are the cheapest in the united states, that ought to make buying the stateminimum coverage a lot more affordable. However, this kind of coverage may not be enough to pay for new or costly vehicles.

Living and driving in California implies that the typical motorist is most likely having to pay around $164 every month to keep their coverage. However, Sacramento motorists can engage in some good deals at this time and obtain quotes as little as $67/mo*! Discover more about California auto insurance here.

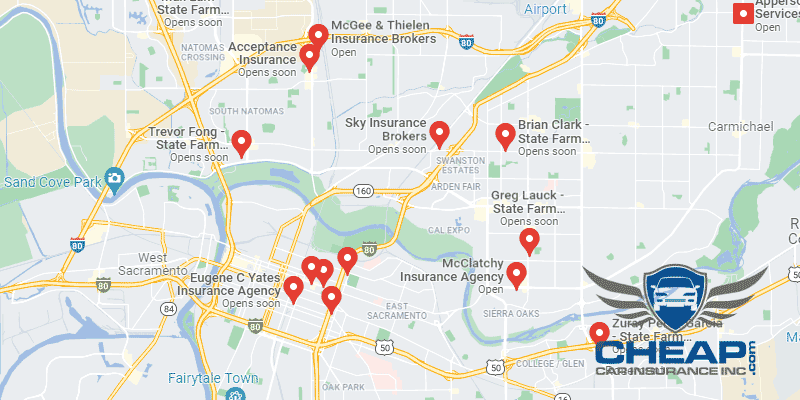

Liberty Mutual, Hartford and Allstate are providing a few of the cheapest premiums in Sacramento at this time. But they are additionally they providing the best customer support? Can they make good on claims rapidly and efficiently? They are important questions you should ask before you decide to consider switching service providers.

Those who underwrite vehicle insurance plans evaluate various variables when establishing insurance rates, including marital status, where you live, your credit report, driving distance to work, and current insurance coverage and limits. On top of that, premiums differ from between companies. To find out if that you’re still forking out the most affordable premium, compare cheap Sacramento Automobile insurance price quotes online.

Most Car Insurance Facts to know in Sacramento CA

You could feel somewhat helpless as soon as your insurance agency is estimating your rate; let’s be honest, almost all the things they will analyze aren’t things you could easily change or control. Thankfully, however, there are still things that you may be able to adjust for increased discounts, for example:

- Your Zip Code

The place you park your vehicle each night will likely have a significant impact on your automobile insurance rate. Generally, motor vehicle insurance is less expensive in non-urban areas because fewer cars and trucks indicates a smaller possibility that you’ll get in a collision with another car. The population of Sacramento is 479,686 plus the average family income is $48,034.

- Automobile Accidents

With as active of a car culture as California has, it is Regrettably no surprise that many of its major cities have a high number of significant accidents each year. And many insurance companies tend to raise rates in areas where accidents are the highest. But if you have a fairly clean driving record, you might be able to ask your insurance agent for discounts.

- Car Thieving in Sacramento

Almost all insurance companies are concerned about auto theft; this runs specifically true for motorists who reside in big towns and cities. The greater the populace, the higher the likelihood that you will have to submit an auto burglary claim. In recent years, there were 2,861 stolen cars in Sacramento. And although the numbers are dropping, it’s still pretty risky to drive around in Sacramento without any Comprehensive coverage on your policy.

- Your Credit Score

In all but 3 states across the country, Automobile insurance companies are legally allowed to raise or lower your rates based on your credit score. For some drivers, especially those with a poor credit score, they will be happy to learn that California is not one of those states. But this might cause a slight increase in rates for drivers who have excellent credit, to balance out costs that insurance companies incur for giving out discounted policies to drivers with poor credit.

- Your Age

Some companies believe that youthful motorists, using their insufficient driving experience, are extremely dangerous to pay for. For this reason they get billed a lot more than somebody that is older. And a few companies, like California Mutual or even the General, feel that they’re too dangerous to pay for whatsoever.

- Your Driving Record

Getting driving violations in your record will unquestionably lift up your rates. But exactly how much it boosts them will be different with respect to the breach. Lesser accidents and speeding tickets will not pack as hard of the punch as reckless driving or perhaps a Drunk driving. And often, you will get your lesser violations waived by having an Accident Forgiveness discount.

- Your Vehicle

The reason if Automobile insurance coverage is to make certain that, if you’re ever within an accident, you’ve got a financial resource to obtain back in your ft and back on the highway as rapidly as you possibly can. And when you are covering an costly vehicle with simply the minimum state needed coverage, and you spend for anything else out of your own wallet, it takes a very lengthy time to replace it all or repair damages.

Minor Car Insurance elements in Sacramento

Here are lesser elements which might or may not influence your monthly premium. When come up with, however, their influence may not be so minor:

- Your Marital Status

Married motorists have the choice of bundling their insurance plans together. And, in return for giving insurance companies that rather more business, they often reward motorists in kind with bundling discount rates.

- Your Gender

Insurance providers can’t appear to create up their brains with regards to gender. Some companies charge more for guys, while some charge women more. Some don’t even charge different rates according to gender whatsoever.

- Your Driving Distance to Work

For such a big city, it can be surprisingly easy to get around Sacramento. Typical commutes only last about 15-20 minutes, although up to 25 minutes is fairly common. Around 71% of residents depend on their own vehicle as their main source of transportation, while another 17% prefer carpooling to work.

You’d believe that driving less miles each year would enable you to get some pretty substantial discount rates. Regrettably, that is not the situation. You’d need to slash your yearly mileage through the 1000’s just to obtain a 4-5% discount, for the most part.

- Your Coverage and Deductibles

Modifying your deductible involves lots of risk, having a potential reward. Raising your deductible might get you some nice discount rates in your monthly premium – however, when you need to file claims, you’ll have to pony up more money at first.

- Education in Sacramento, CA

23% of Sacramento residents have not yet completed their secondary level of education, and an additional 22% have in fact completed their high school diploma requirements. But if you want to lower your insurance rate, you need a little more than a high school education. Most providers offer lower rates to motorists who have an advanced degree.

Sacramento has a plethora of educational possibilities for any prospective student. California State University has nearly 26,000 students enrolled each term and offers bachelor’s degrees in nearly every major field of study. Golden Gate University is another four-year institution in the Sacramento area. For an associate’s degree, you might want to look into Cosumnes River, American River, or Sacramento City College.

Insurance is among the most essential investment decisions you can possibly make as a shopper. You should ensure you uncover a legitimate, accountable agency which will follow through on their guarantees. A small number of automobile insurance providers happen to be greater at this than the others, and performing a conscientious internet based investigation will let you differentiate the beneficial from the unfavorable.

How We Conducted Our Car Insurance Analysis

Sources:

California Department of Insurance

California Division of Financial Institutions

Department of Highway Safety and Motor Vehicles

Get a Quote Online in Minutes