Cheap Auto Insurance in Los Angeles, CA

In the market for auto insurance in Los Angeles, CA? At CheapCarInsuranceinc.com, you can easily find the best insurance rates near you. To acquire free car insurance quotes from the leading providers today, input your zip code into the quote box on this page.

There is no one reason Los Angeles is the second most populous city in the United States; there are multiple. For starters, Hollywood attracts thousands of aspiring actors, actresses, and models with the hope of making it big on the silver screen. Additionally, Los Angeles has miles of beautiful, sandy beaches and year-round sunny weather which attracts a large amount of tourists. Los Angeles also possesses a great deal of cultural and ethnic diversity.

- Fun fact: Did you know that Los Angeles is #3 on the list of “Top 50 cities with greatest precentage of males in occupations: Legal occupations: (population 50,000+)? Learn more about Los Angeles, CA.

Coverage Requirements - Auto Insurance in Los Angeles California

Driving legally in California requires the following types of insurance coverage to be purchased:

| Coverage | Requirements | Most Common |

| Liability Bodily Injury | 15,000/30,000 | 100,000/300,000 |

| Liability Property Damage | 5,000 | 100,000 |

| Bodily Injury - Motorist Uninsured | Not required | 20,000/40,000 |

| Not required Coverage | Medical Payments Coverage | 5,000 |

| Collision Coverage | Not required Coverage | 700 Insurance deductible |

| Comprehensive | Not required | 250 deductible |

While purchasing the minimum legal requirement for auto coverage might seem like the better deal, beware the allure of a cheaper insurance policy with less coverage. With Liability coverage, for example, your insurer will only pay out claims if you are responsible for the accident or incident which damaged your vehicle. Should your car be damaged by any other means, you’re on your own.

As you may already know, average California monthly premiums are quite high – somewhere in the neighborhood of $164 per month. But even in Los Angeles, you can find low rates for $103/mo* or less. You just have to know what discounts to look for when you shop around.

Want the lowest rates in LA? Then you might want to look into Allstate, Nationwide, or Hartford. But rates aren’t everything. Some companies might be worth forking out a little extra for good customer service and simple claims processing. Don’t want to pay such high prices for Los Angeles car insurance? Then keep reading to discover ways you can save on California auto insurance!

Auto insurance companies evaluate various elements when calculating insurance quotes, including gender, occupation, your driving experience, your automobile’s make/model, and business use of the vehicle. Also keep in mind that premiums differ from carrier to carrier. To make sure you’re still getting the cheapest rate, compare cheap Los Angeles auto insurance quotes online.

Most Car Insurance Facts to know in Los Angeles CA

There are many things which may factor into the rate quotes you get. Even though a portion of these details aren’t really anything you can do something about, some of them are elements which you can change for the better. Here are a few components which can alter your car insurance premium:

- Your Zip code

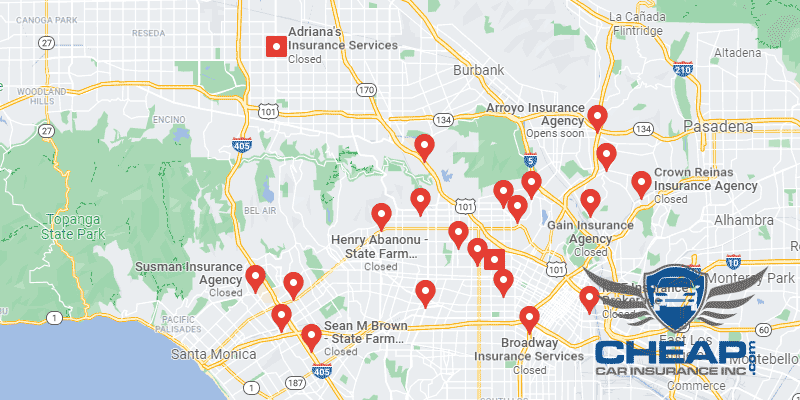

Your auto insurance rates may differ depending on where you call home. In general, highly populated cities have higher auto insurance rates because the extra amount of drivers on the road increases the likelihood of an accident! The population of Los Angeles is 3,884,307 and the median household income is $48,466.

- Automobile Accidents

In a city with more than 3.8 million people, and virtually no public transit system to alleviate traffic congestion, there are going to be a fairly high number of accidents. This, in turn, will increase your premiums for Automobile insurance.

- Car Thieving in Los Angeles

Auto theft is a major problem, especially in densely populated cities. If your location and/or vehicle model put you at a greater risk for theft, you may have trouble finding low-cost car insurance. The total number of stolen vehicles in Los Angeles was 14,382 back in 2013. Overall, that’s a high number, but the per capita rate of theft is actually fairly low. Regardless, you should still think about adding Comprehensive coverage to protect yourself from auto theft.

- Your Credit Score

California is a special case when it comes to Automobile insurance and credit scores. There are three states where it is illegal for insurance companies to discriminate based on your credit, and California is one of them. Although this can save you some significant cash if you have terrible credit, overall California insurance rates will cost more to offset the insurance company’s financial risk.

- Your Age

Regrettably, Teenage motorists are the most likely to get into an expensive accident, statistically speaking. And major insurance companies prefer to charge them higher rates in order to offset the potential risk of forking out out expensive claims. If you’re a teenage driver and you’re still in school, ask about Good Student and Driver’s Ed discounts. They can save you a ton in premiums.

- Your Driving Record

multiple major insurance providers are adopting an “accident forgiveness” discount policy. This means that your provider will offer to ignore one or more recent minor driving violations in favor of offering you a lower rate.

- Your Vehicle

If you have a common, inexpensive car, it will be much easier to fix or replace should the worst happen than an expensive, luxury vehicle. And an inexpensive car doesn’t require an extensive, comprehensive insurance policy.

Minor Car Insurance elements in Los Angeles

You don’t need to pay as much attention to the following elements, but it’s good to at least keep them in mind:

- Your Marital Status

- Your Gender

The truth is that no specific gender is winning the battle of the sexes when it comes to driving. Most providers these days don’t charge different rates for male and female drivers. And those who still do can’t make up their minds on who should be charged more – some providers will charge women more, while others will offer higher quotes to men.

- Your Driving Distance to Work

The typical commute time for Los Angeles workers can range from 30-35 minutes per trip. Because of Los Angeles traffic problems, almost a quarter of all workers prefer to carpool or take the bus in order to get to and from work. Around 65% still drive to work in their own car, contributing further to traffic congestion.

Are you worried about driving too many miles? Or that doing too much leisurely driving is costing you in higher insurance premiums? Don’t fret. Even if you severely limit your yearly mileage, you’ll save 3-4% at best. Whatever you do, try not to register your vehicle for business – you could face rate hikes of 10% or more.

- Your Coverage and Deductibles

Need more coverage, but don’t have enough money to budget each month? Talk to your insurance agent about raising your deductible. Yes, you will have to pay more in the event that you need to file a claim, but think about how much you can save long-term with a lower monthly payment.

- Your Education

Most drivers in Los Angeles have yet to complete their high school education. This is unfortunate for LA drivers, because obtaining a higher education is the best way to get discounts on Auto insurance. For those who do have a high school diploma, an equal number of people also have a bachelor’s degree.

The Los Angeles area offers three different University of California campuses as well as nearly two dozen private institutions. Both USC and UCLA are known nationally for being major universities in their respective research fields.

Determining your individual financial risk can be very confusing or impossible for the typical insurance shopper. Insurance companies have an advantage over consumers due to their statistics and experiential knowledge. Learn what insurance companies don’t want you to know.

How We Conducted Our Car Insurance Analysis

Sources:

California Department of Insurance

California Division of Financial Institutions

Department of Highway Safety and Motor Vehicles

Compare Free Los Angeles Auto Insurance Quotes Now. These Companies Offer Lowest Rates in Your Area – Enter Your Details Below To Get the Quotes.