Cheap Auto Insurance in San Francisco, CA

Are you looking for auto insurance in San Francisco? At CheapCarInsuranceinc.com, you will discover the cheapest insurance rates close to you. To acquire free car insurance quotes from the very best providers today, put your zip code into the quote box on this page.

San Francisco is known for a great many things, from cultural diversity to hilly topography to year-round sunny weather. But did you also know that San Francisco is home to a major international port? Moreover, San Francisco is both a major player in the insurance business as well as strategically located for access to Silicon Valley.

- Fun fact: Did you know that San Francisco is #4 on the list of “Top 50 cities with greatest precentage of males in occupations: Religious workers (population 50,000+)”? Learn more about San Francisco, CA.

Coverage Requirements - Auto Insurance in San Francisco California

Driving legally in California carries with it the following insurance requirements:

| Coverage | Requirements | Most Common |

| Liability Bodily Injury | 15,000/30,000 | 100,000/300,000 |

| Liability Property Damage | 5,000 | 100,000 |

| Bodily Injury - Motorist Uninsured | Not required | 20,000/40,000 |

| Not required Coverage | Medical Payments Coverage | 5,000 |

| Collision Coverage | Not required Coverage | 700 Insurance deductible |

| Comprehensive | Not required | 250 deductible |

Remember that auto coverage is a delicate balance of purchasing as much coverage as you can afford. Getting the bare minimum will only pay out claims on accidents which are your fault. For every other possible scenario, your insurance won’t pay.

It’s probably no surprise that average California Automobile insurance rates are fairly high – the typical motorist can expect to pay $164 monthly. However, astute San Francisco drivers can find affordable rates in their area for as low as $61/mo*!

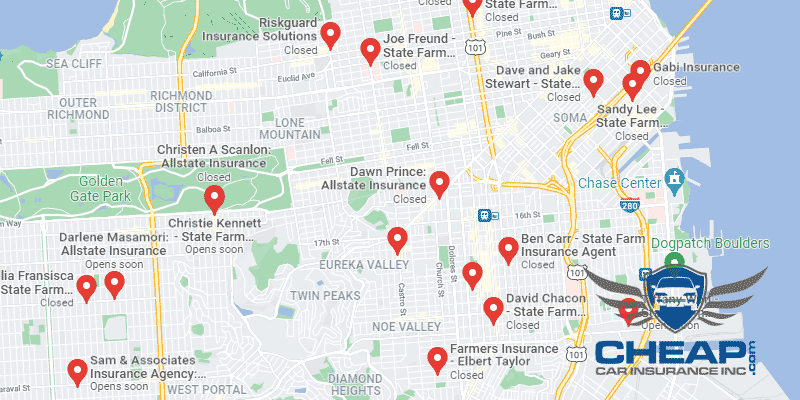

Farmers, Allstate, and Nationwide are offering the lowest rates in San Francisco right now. But just because a company offers a low rate doesn’t mean that you’re getting the best deal. In the long run, a company with bad customer service or a complicated claims process might not be worth the cheaper rate.

Auto insurance providers evaluate different elements when establishing insurance quotes, including marital status, credit score/rating, years of driving experience, past accidents, and current insurance coverage and limits. Also keep in mind that premiums vary from company to company. To make sure you’re still being charged the cheapest rate, compare cheap San Francisco auto insurance quotes online.

Most Car Insurance Facts to know in San Francisco CA

There is a variety of numerous items that could factor into the rate quotes you are offered. While many of these elements aren’t actually anything you can do something about, a few of them are elements which you can change for the better. Here are some things which might alter your car insurance premium:

- Your Zip code

Where you park your car each night will have a major impact on your auto insurance rate. Generally, car insurance is cheaper in rural areas because fewer cars means a smaller chance that you will get into a collision with another vehicle. The population of San Francisco is 837,442 and the median household income is $77,485.

- Automobile Accidents

The higher the rate of deadly accidents in your zip code, the higher your monthly premiums will be. Although San Francisco’s numbers seem high, they’re fairly low compared to the overall population – especially with regard to drunk driving Deadlyities.

- Car Thieving in San Francisco

Auto theft is a major problem, especially in densely populated cities. If your location and/or vehicle model put you at a greater risk for theft, you may have trouble finding low-cost car insurance. The total number of stolen vehicles in San Francisco was 3,903 back in 2010.and discuss comprehensive insurance coverage

- Your Credit Score

California is one of only three states in which it is illegal for auto insurance companies to alter your rates based on your credit score. While this might save some motorists money, you can bet that insurance companies are probably charging every driver a little bit more to offset potential risks.

- Your Age

Because Teenage motorists have so little experience behind the wheel, they are statistically more likely to get into an accident. To offset this potential risk, they are charged dramatically higher monthly rates. Luckily, there are “Good Student” and Driver’s Ed discounts which can help lower their bills.

- Your Driving Record

Insurance providers are increasingly offering “Accident Forgiveness” discounts for drivers with minor violations on their record. However, there are limits to these discounts. Most of them won’t apply to significant citations, such as a DUI or a Reckless Driving charge. Not only are such offenses expensive, but you may end up losing your coverage.

- Your Vehicle

If you can afford an expensive, luxury vehicle, make sure you set aside enough money for the expensive Automobile insurance that comes with it. Unlike your average sedan, bare minimum coverage isn’t going to be enough to properly insure a luxury vehicle.

Minor Car Insurance elements in San Francisco

Keep the following elements in mind when you’re shopping around for an insurance policy:

- Your Marital Status

Married couples have the option to bundle multiple insurance policies together, least of which are their Automobile insurance policies. You can save a bundle by bundling renters or homeowner’s insurance, too. Just make sure your preferred provider offers all of these policy options to their customers.

- Your Gender

These days, fewer and fewer companies are charging different rates based on gender. Many major providers charge the same, all other attributes being equal. Even if your provider does alter premiums based on gender, they are unlikely to waver by more than 2-3%.

- Your Driving Distance to Work

The average commute to work for most drivers can last at least 30 minutes in San Francisco. However, only 37% of residents are driving to work alone in their own vehicle. Therefore, the majority of San Francisco natives are using a variety of alternative methods to get to work.

You might think that driving less in a pedestrian city like San Francisco would save you a ton on monthly premiums – but you’d be off by quite a bit. Even infrequent drivers may only save 3-4% on their monthly costs. Business vehicle owners, on the other hand, can expect to pay 11% higher premiums.

- Your Coverage and Deductibles

One way to increase your coverage without forking out a fortune each month is to raise your deductible. A high deductible, although unpleasant to pay if you need to file a claim, can dramatically lower your monthly bill.

- Your Education

Improving upon your education can also improve your car insurance rate. Contrary to popular belief, having a high degree gives you much bigger discounts than having a prestigious job or a high salary. In San Francisco, more than ¼ of all motorists have bachelor’s degrees. A smaller percentage of drivers have yet to complete their high school education.

No matter what you want to study, San Francisco has a university to fit your needs. The Academy of Art College is located in San Francisco, as well as the Hastings College of law. The University of California San Francisco also has a campus in the city, as well as San Francisco State University and Golden Gate University, to name only a few.

Finding affordable auto insurance can be a hassle. There’s a lot of information you need to consider, and figuring out how insurance companies evaluate your potential risk can be complicated. But don’t let the wrong insurance company talk you into purchasing the wrong policy.

How We Conducted Our Car Insurance Analysis

Sources:

California Department of Insurance

California Division of Financial Institutions

Department of Highway Safety and Motor Vehicles

Ready to Compare Rates? These Companies Offer Lowest Premiums on Auto Insurance in San Francisco, CA – Enter Your State To Get Quotes!