Cheap Auto Insurance in Santa Ana, CA

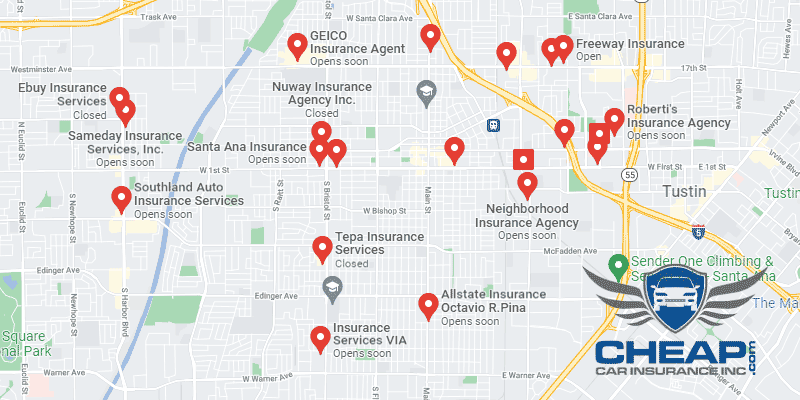

Want cheap auto insurance in Santa Ana, CA? At CheapCarInsuranceinc.com, we can help you find it. All you need to do is type in your local zip code in the quote box down below – it’s so simple!

The city of Santa Ana is located approximately 10 miles away from the Pacific Coast along the Santa Ana River. It also shares its namesake with the Santa Ana Mountains, and the annual Santa Ana winds (which occasionally exacerbate seasonal wildfire problems). Although Santa Ana is only the 57th most populated city in all of the United States, its population density ranks it among tightly-packed cities such as New York and Boston.

- Fun fact: you may be surprised to find out that Santa Ana is #2 on the list of “Top 50 cities with greatest precentage of females in occupations: Sales representatives, services, wholesale and manufacturing (population 50,000+)”. Learn more about Santa Ana by visiting here.

Examine Average California Santa Ana Car Insurance Quotes – Customers may well save hundreds each year!

The average motorist can be expected to pay $1,616 for car insurance in Santa Ana. Residents may be disappointed to learn that not only is this price 6% higher than anything else in Orange County, but a whopping 31% higher than typical rates for auto insurance in California. Fortunately, you don’t have to agree to such high prices if you don’t wish to; just keep reading and uncover new ways to save money!

Those that offer vehicle insurance plans evaluate multiple elements when establishing insurance prices, such as marital status, where you live, your credit report, miles driven each year, and theft protection devices. Also don’t forget that premiums could differ from one company to another. To find out if that you’re still getting the lowest-cost fee, compare cheap Santa Ana Automobile insurance costs on the internet.

elements that will Determine the Costs of Auto Insurance in Santa Ana, California

The moment your motor vehicle insurance company prepares to come up with your plan, they take quite a few aspects into account. Many of these, for instance how old you are or your specific region, are usually very unlikely to change. Here are a few additional examples:

- Your Zip Code

The spot where you park your automobile every night will probably have a major impact on your motor vehicle insurance rate. Usually, automobile insurance is cheaper in non-urban regions because fewer vehicles means a smaller chance that you’ll get into a collision with some other automobile. The population of Santa Ana is 324,528 plus the common household income is $53,211.

- Car Thieving

Almost all insurance companies are concerned regarding auto theft; this is especially true for car owners who live in big cities. The higher the population, the higher the chance that you will have to submit an auto robbery claim. In recent years, there were 1,275 stolen cars in Santa Ana.

- Driving Distance to Work

Santa Ana residents do their best to alleviate traffic problems (25% carpool and 6% take the bus), but for most, it still takes at least 30 minutes to get to work each day. Around 54% still drive alone in their own vehicle for their daily commute, which might result in some significant traffic snarls in such a densely populated city.

- Your Education Level and your Insurance Rates

One reason insurance rates in Santa Ana might be so high could have to do with education; more than half of the population (57%) has yet to complete all four years of high school and earn their diploma. An additional 16% have finished high school or earned an equivalent degree. But it’s never too late to go back to school, and doing so could immensely lower your automobile insurance costs!

multiple possibilities for achieving a higher level of education are present in Santa Ana. One of the largest is the Santa Ana College, which is a community college open to the public. California Coast University is a private, distance education facility which is located in Santa Ana as well. Those interested in the legal field can also check out Taft Law School.

The Lowest Car Insurance Rates are Online! Get the Best Car Insurance.

Insurance is among the most important investments you can make as an automobile owner. You must ensure you discover a reputable, accountable business who is going to follow through on their offers. A handful of vehicle insurance agencies are usually better at this than the others, and conducting a conscientious online investigation can assist you distinguish the good from the inadequate.