Cheap Auto Insurance in Albany, GA

Looking for cheap auto insurance in Albany, GA? CheapCarInsuranceinc.com can help you find what you need. What you need to do is enter in your postal code in the search widget below – it’s that simple!

Albany has historical roots dating back to the early 1800’s when the city first sprang up as both a shipping port and eventually an important hub for railroad transportation. Although most of the economy today is based on education and health care, it still maintains tree-lined streets and is an official member of the Tree City USA program. Learn more about Georgia auto insurance requirements here.

- Fun Fact: watch out for those cuts…because Albany is #3 on the list of “Top 50 cities with greatest precentage of males working in industry: Paper (population 50,000+)”. Intrigued by learning more about Albany? Click here!

Coverage Requirements - Auto Insurance in Albany Georgia

Driving legally in Albany requires:

| Coverage | Requirements | Most Common |

| Liability Bodily Injury | 25,500/50,500 | 105,000/305,000 |

| Liability Property Damage | 30,000 | 60,000 |

| Bodily Injury - Motorist Uninsured | Not required | 30,000/55,000 |

| Not required Coverage | Medical Payments Coverage | 5,000 |

| Collision Coverage | Not required Coverage | 700 Insurance deductible |

| Comprehensive Coverage | Not required Insurance | 300 deductible |

In comparison with other states, the minimum requirement of legal driving status in Georgia is rather small. However, buying minimum coverage only safeguards you in a few instances, and you might be held financially responsible for what your provider will not shell out.

Astoundingly, average payments in Georgia can run up to $183 for many motorists. But residing in Albany includes certain advantages – and something of individuals advantages is the fact that motorists in your town could lower their payments lower to $37/mo* or fewer!

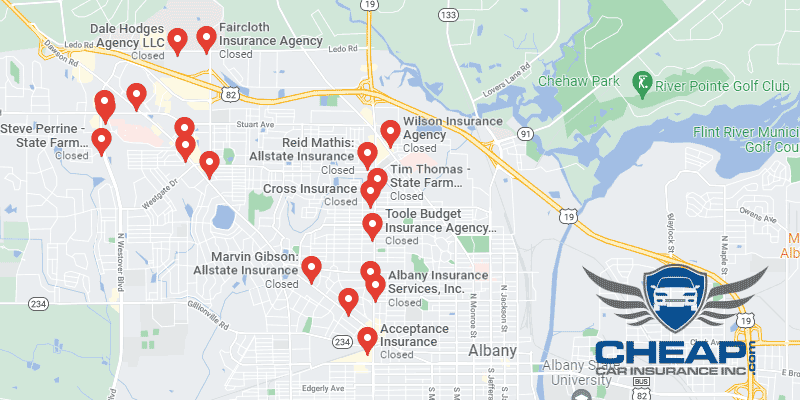

There are specific providers in Georgia (namely Nationwide, Allied, and Hartford) who are attempting to attract business by providing a few of the cheapest rates in Albany. But don’t forget, reduced rates aren’t everything with regards to insurance. Customer support and claims are essential elements, too.

Companies that supply vehicle insurance plans evaluate multiple elements while figuring out quotes, which includes gender, where you live, type of vehicle owned, education, and current insurance coverage and limits. Also bear in mind that premiums differ from company to company. To find out if you are still receiving the best fee, do a comparison of cheap Albany automobile insurance prices via the internet.

Most Car Insurance Facts to know in Albany GA

At the time your motor vehicle insurance agency gets ready to write your plan, they take quite a few issues into mind. Some, just like your real age or your precise location, tend to be not possible to improve. A few additional elements are:

- Your Zip Code

automobile insurance providers must know where you live (or where you will be driving a motor vehicle usually) to be able to calculate the probability of any sort of accident. It all boils down to a very simple notion: the greater the human population, the more vehicles you’ll encounter while driving, and also the more chances you could have to hit or even be hit by an additional car or truck. The populace of Albany is 76,185 plus the normal household income is $28,921.

- Automobile Accidents

The number of significant accidents around Albany seems fairly low, but on a per capita basis they still might be too high for most insurance companies. And when your insurance provider thinks that you live in a dangerous area, they are likely to raise rates on you (unless you qualify for any safe driver discounts, that is).

- Car Thieving in Albany

Anti-theft technology is a sensible way to guard yourself from auto thievery. They are fairly affordable, simple to have installed, and once outfitted, require little effort by you. And best of all, most insurance agencies will provide you with a discount on your insurance simply for having one! In Albany, there were 173 Car Thieving in 2013. Although thefts have been pleasantly declining in recent years, that’s no excuse to put yourself at financial risk by choosing not to carry Comprehensive coverage.

- Your Credit Score

Typically, motorists who’ve a bad credit score are having to pay about two times around someone by having an excellent credit rating. Some information mill more forgiving than the others, however, and it will cost looking around in case your credit is under perfect.

- Your Age

Older motorists are less inclined to enter into any sort of accident because of their extensive driving experience, and therefore are billed lower rates consequently. More youthful motorists, especially teenagers, really are a different story. You may have the ability to be eligible for a a great Student or driving class discount, however your rates will still be high.

- Your Driving Record

Getting a clear driving history you can get some significant discount rates in your auto policy. Regrettably, for many motorists, staying away from the periodic speeding ticket or minor accident is simpler stated than can be done. This is exactly why competitive information mill offering Accident Forgiveness discount rates to draw in more business.

- Your Vehicle

The cost connected with insuring an extravagance vehicle has more related to the quantity of insurance you purchase, as opposed to the vehicle itself. In the end, you are not likely to cover a Ferrari or perhaps a Porsche with condition minimum Liability. You are likely to purchase a variety of coverage options, as well as in sufficiently high comes down to cover the price of your automobile.

Minor Car Insurance elements in Albany

Don’t overlook other key elements, though:

- Your Marital Status

Married people have been in the very best position to benefit from the large bundling discount rates which insurance providers prefer to offer. And bundling your auto guidelines is only the beginning. You may also bundle your renters or home insurance in case your provider offers such guidelines, too.

- Your Gender

Generally, most insurance firms will not charge drastically different premiums according to gender alone. Some companies still do, however the difference is nothing more than a couple of dollars monthly. And whether this penalizes man or woman motorists can change according to the organization providing you with the quote.

- Your Driving Distance to Work

Like many larger cities, a little over 75% of the population relies upon their own vehicle in order to commute from place to place; alternatively, around 17% carpool. Despite the lack of public transportation, commute times are still relatively short, with most trips lasting around 15 minutes on average.

vehicles insured for business or professional reasons typically cost around 11% greater than the typical vehicle or truck in payments. Other similar elements, for example yearly mileage or driving to operateOrcollege, generally only lower or raise your payment per month with a couple of percentage points.

- Your Coverage and Deductibles

Your deductible may be the fee you spend before insurance companies pays on Collision or Comprehensive claims. However, you can lift up your deductible, be responsible for lower monthly repayments.

- Education in Albany, GA

It’s becoming commonplace with automobile insurance agencies to base part of your premium costs on your level of education. To put it simply, the more education you have, the less costly your insurance will be. In Albany, around 28% of the population has not yet completed their secondary level of education. An additional 27% or residents have gone on to successfully earn a high school diploma.

For those looking to improve upon their education, Albany has some local institutions worth looking into. Albany State University is part of the public state university system and has a historically diverse student body. Darton College, typically a two-year institution, has recently been instituting four-year degree programs. And for vocational training, look no further than the Albany Technical College.

You mustn’t allow an undesirable motor vehicle insurance company to persuade you into purchasing a motor vehicle insurance policy that isn’t ideal for you. Sure, the volume of data needed in order to assess your own risk profile could be overpowering, however comparison sites such as this may also help make your search less confusing. Just provide just a few specifics below, and then we’ll take it from there.

How We Conducted Our Car Insurance Analysis

Sources:

Georgia Department of Law Consumer Protection Unit

Georgia Department of Human Services Office of Financial Services

Department of Highway Safety and Motor Vehicles

Get started comparing rates immediately. It only takes a couple of minutes, and you will save a bundle!