Cheap Auto Insurance in Columbus, GA

Do you need auto insurance in Columbus? At CheapCarInsuranceinc.com, you will find the cheapest insurance rates in your city. To get free car insurance quotes from the major providers today, input your zip code into the quote box on this page.

According to such publications as Best Life Magazine, Columbus has been rated as one of the best places to live within the United States. It is a major center of culture and tourism, as well as a residential area for military employees of Fort Benning. Columbus is also home to multiple minor-league sports teams.

- Fun fact: Did you know that Columbus is #50 on the list of “Top 100 cities with largest land areas”? Learn more about Columbus.

Coverage Requirements - Auto Insurance in Columbus Georgia

To drive legally in Georgia, you will need:

| Coverage | Requirements | Most Common |

| Liability Bodily Injury | 25,500/50,500 | 105,000/305,000 |

| Liability Property Damage | 30,000 | 60,000 |

| Bodily Injury - Motorist Uninsured | Not required | 30,000/55,000 |

| Not required Coverage | Medical Payments Coverage | 5,000 |

| Collision Coverage | Not required Coverage | 700 Insurance deductible |

| Comprehensive Coverage | Not required Insurance | 300 deductible |

If you think Liability coverage will be enough, give that decision a little extra thought. After all, Liability coverage only pays out claims if the incident was something you were deemed liable for. Which means that if someone hits you, or an act of nature damages your vehicle, you are 100% responsible for those costs. Your insurance company won’t pay a dime.

As you may already know, average Georgia monthly premiums can be quite high – somewhere in the neighborhood of $183 per month. But even in Columbus, you can find low rates for $40/mo* or less. You just have to know what discounts to look for when you shop around.

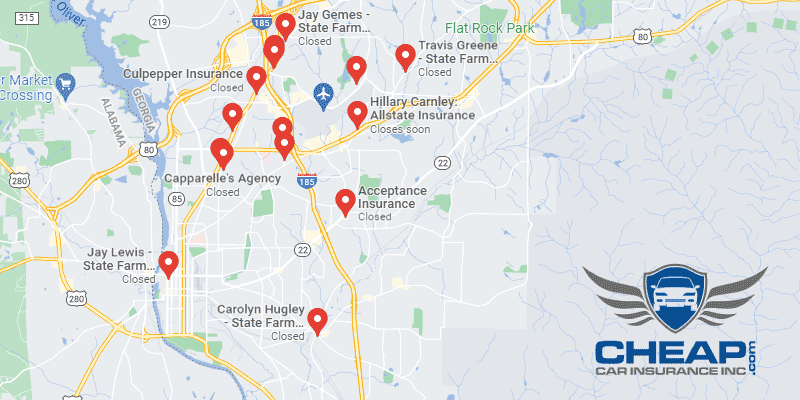

The Geico, Allied, and Allstate are offering some impressively low rates on Automobile insurance policies for Columbus residents. But if you’re thinking about switching providers, understand that there’s more to choosing a company than a low rate. Customer service is important too, as well as their claims process.

Auto insurance providers consider multiple elements when calculating insurance quotes, including geography, zip code, your credit score/rating, driving distance to work, and business use of the vehicle. In addition, premiums vary from carrier to carrier. To verify you’re still being charged the most favorable rate, learn more about auto insurance Georgia.

Most Car Insurance Facts to know in Columbus GA

There are numerous ways your car insurance rate might be estimated. But not all of it is out of your control; there are things you can do so that you can control what discounts you are eligible to obtain. Listed below are some of these components in greater detail:

- Your Zip Code

Where you park your car each night will have a major impact on your auto insurance rate. Generally, car insurance is cheaper in rural areas because fewer cars means a smaller chance that you will get into a collision with another vehicle. The population of Columbus is 185,888 and the median household income is $40,563.

- Automobile Accidents

If your zip code has high accident rates, then odds are you will have to face higher insurance premiums than drivers in nearby cities. Take a look at the chart above, and talk to your insurance company about safe driver discounts if you think these numbers may be influencing your rate.

- Car Thieving in Columbus

Living in a large city (Especially one with a high crime rate) will increase your risk of being a victim of auto theft. If your general location has high rates of theft and claims, you can expect to pay more for auto insurance to offset these costs. The total number of stolen vehicles in Columbus was 1,108 back in 2013. To protect yourself from auto theft, add Comprehensive coverage to your policy. Yes, it can be expensive – but so can replacing your stolen car.

- Your Credit Score

Auto insurance providers put a lot of stock into your credit score. The better your credit, the lower your rate will be. However, having a poor credit score can immensely raise your rates. As you can see in the chart, some companies will charge you double (or more) than someone with excellent credit.

- Your Age

As you can see from the chart below, young teenage drivers get charged immensely higher rates. Their youth, as well as their lack of driving experience, make them much more risky to insure. However, teenage drivers can try to alleviate some of this financial stress by looking into a Good Student discount, or taking additional driver education courses.

- Your Driving Record

“Accident Forgiveness” is a new type of discount that more and more insurance providers are beginning to offer. It gives you the opportunity to virtually erase a minor traffic citation from your record, effectively lowering your monthly premium. It is unlikely to work for more significant violations, such as a DUI or Reckless Driving, however.

- Your Vehicle

If you have the disposable income for a luxury vehicle, make sure that you also possess some luxury insurance to go with it. Because carrying the bare minimum coverage for an expensive vehicle will likely leave you holding the bill in most claim filing situations.

Minor Car Insurance elements in Columbus

- Your Marital Status

Married couples can get all sorts of discounts – if they know how to bundle their insurance policies, that is. The most obvious choice is to bundle you and your spouse’s auto policies under the same company. And if that company offers other insurance – such as boating, homeowners, or life insurance – you can bundle those too for further discounts.

- Your Gender

This may be hard for some people to believe, but most companies don’t charge radically different rates for male or female drivers. Many companies these days charge the exact same rate, all other circumstances being equal.

- Your Driving Distance to Work

The typical commute time for Columbus workers can range between 15-26 minutes. Around 75% of motorists drive their own car in to work, while over 12% prefer to carpool with co-workers.

It doesn’t matter why you drive, or how many miles you drive each year – even though insurance companies do tend to ask such questions. In reality, your answers will only change your premiums by a few percentage points. Business vehicles, however, tend to cost around 10-13% more to insure on average.

- Your Coverage and Deductibles

You can get additional forms of coverage added to your policy, or get covered in larger amounts, and still pay a relatively low rate if you raise your deductible. Just remember to put away part of that savings for a rainy day, in case you do ever have to file a claim.

- Education in Columbus, GA

A sizeable portion of drivers in Columbus have attained a high school education, while a smaller percentage has yet to complete high school. If you’ve been thinking about going back to school, keep in mind that a higher education can get you a better price on your car insurance (even more so than having a fancy job or a high yearly income).

Columbus has a vast array of public and private institutions for higher education. For a four-year degree, you can look into Columbus State University, or Columbus Technical College for a more specialized trade. Local private schools include the Christian Life School of Theology and the Southeastern Beauty School.

Regrettably for most insurance companies, a simple internet search can reveal many of their trade secrets. But even with the proper information, it can still be confusing for you as an individual to figure out your risk profile and find low-cost insurance. Make sure you do your due diligence before you commit to your next car insurance policy.

How We Conducted Our Car Insurance Analysis

Sources:

Georgia Department of Law Consumer Protection Unit

Georgia Department of Human Services Office of Financial Services

Department of Highway Safety and Motor Vehicles

Find Cheapest Auto Insurance In Georgia. Lowest Rates from $29/ Month!