Cheap Auto Insurance in Roswell, GA

Are you looking for cheap auto insurance in Roswell, GA? With CheapCarInsuranceinc.com, it’s only a click away. What you need to do is provide your postal code into the quote banner below – it’s that easy!

Not to be confused with the New Mexico City of the same name, Roswell is a well-to-do suburb located north of the Atlanta major metropolitan area. It is named for Roswell King, who founded the city in the 1830’s by building the area’s first cotton mill. Learn more about auto insurance in Georgia here.

- Fun Fact: careful, that paint might still be drying…because Roswell is #35 on the list of “Top 100 cities with newest houses (pop. 50,000+)”. Learn all about Roswell by visiting here.

Coverage Requirements - Auto Insurance in Roswell Georgia

Driving legally in Roswell requires:

| Coverage | Requirements | Most Common |

| Liability Bodily Injury | 25,500/50,500 | 105,000/305,000 |

| Liability Property Damage | 30,000 | 60,000 |

| Bodily Injury - Motorist Uninsured | Not required | 30,000/55,000 |

| Not required Coverage | Medical Payments Coverage | 5,000 |

| Collision Coverage | Not required Coverage | 700 Insurance deductible |

| Comprehensive Coverage | Not required Insurance | 300 deductible |

Georgia has a few of the cheapest needs for insurance in comparison with other states. But simply since you can obtain the minimum coverage, does not mean you would be best served that way. This is especially true the more youthful your automobile is, or if you are still making repayments onto it.

Regrettably, the typical payment for many Georgia motorists is up to $183/month or even more. However, residing in Roswell has some secret advantages – including the opportunity to get insured for $45/mo* or fewer!

If you would like the cheapest rate possible, then you might like to consider The Geico, Nationwide, or Hartford for your forthcoming policy. Try not to hurry to a different company just to obtain a lower premium. Make certain they provide top-notch customer support and claims filing, too.

Companies which provide vehicle insurance coverage consider numerous variables while establishing insurance prices, especially gender, geography, type of vehicle owned, education, and whether you use your vehicle for business or pleasure. Also bear in mind that premiums differ from company to company. To make sure you are still forking out the most affordable cost, look at cheap Roswell Automobile insurance price quotes via the internet.

Most Car Insurance Facts to know in Roswell GA

When your motor vehicle insurance provider gets ready to build an insurance policy, they’ll take many specifics into consideration. Some, for instance credit history or your precise region, are very unlikely to vary. Below some additional elements:

- Your Zip Code

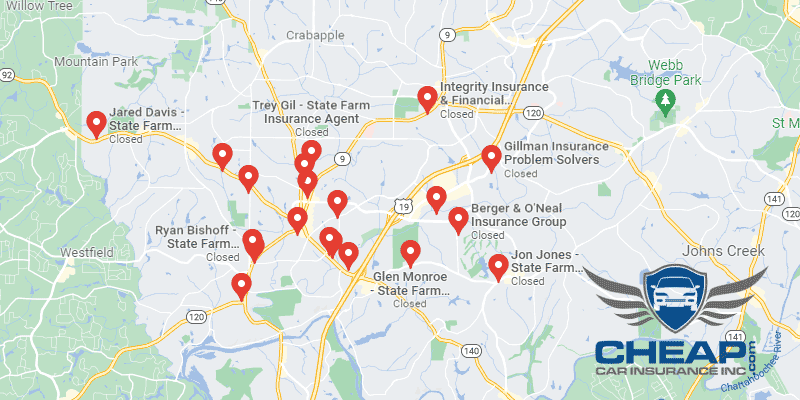

Vehicle insurance companies want to know where you live (or where you are going to be driving a vehicle usually) to be able to estimate the likelihood of a vehicle accident. The whole thing comes down to a very simple idea: the higher the populace, the more vehicles you’ll encounter while travelling, and therefore the more chances you may have to be involved in a collision with or perhaps be hit by yet another car. The populace of Roswell is 94,034 and also the average household income is $72,317.

- Automobile Accidents

Roswell has some very low rates when it comes to significant accidents in your area. And this is especially true when you factor in the overall population. And this is great news, aside from the obvious reasons: drivers who live in zip codes with low accident rates are usually charged cheaper rates automatically.

- Car Thieving in Roswell

Obtaining inexpensive motor vehicle insurance can be challenging should you be at risk for auto theft. multiple common car or truck models usually are attractive to thieves, and also cars or trucks which might be left typically in large urban centers. The total number of stolen vehicles in 2010 dropped to only 75 for Roswell. While Comprehensive coverage may not be all that necessary for theft protection, but there are many other situations in which only Comprehensive coverage will pay out claims for damage to your vehicle.

- Your Credit Score

In Roswell, much like in lots of other areas, your credit rating is a significant component in how your Automobile insurance can cost you. Within the chart, the main difference is obvious: motorists with a bad credit score are having to pay double (or even more) than motorists having a perfect credit rating.

- Your Age

The less driving experience you’ve earned, the greater your chances are to get involved with or cause any sort of accident this is exactly why youthful grown ups and teenagers finish up getting billed a lot more. Fortunately, you will find Driver’s Ed and Good Student discount rates readily available for responsible youthful people.

- Your Driving Record

Whether you have been inside a significant accident or collected a couple of minor speeding tickets, odds are your rates will increase having a under perfect driving history. Try not to panic yet – you will find providers who offer “Accident Forgiveness” discount rates that will decrease your rate per month.

- Your Vehicle

The greater costly your vehicle is, the greater insurance policy you will have to purchase to be able to pay for it precisely. In case your Bentley will get totaled or perhaps your Ferrari is stolen, and all you’ve got may be the condition minimum coverage, you’ll essentially finish up having to pay for an entire new luxury vehicle. This is exactly why it’s easier to get precisely the coverage you’ll need, even when it will are more expensive every month.

Minor Car Insurance elements in Roswell

Don’t overlook other key elements, though:

- Your Marital Status

If you’re married, you’re most likely already conscious of the functional discount rates you will get from bundling your auto policy together with your spouse. The only real catch, obviously, is you need to both be insured through the same company.

- Your Gender

Lately, many insurance firms started charging men and women motorists exactly the same rates. Individuals that also possess a gender gap may charge a positive change of just one-2%, for the most part. And figuring out which gender pays the greater rate differs from one insurance provider to a different.

- Your Driving Distance to Work

Living in the suburbs might seem nice, but urban sprawl usually creates traffic problems. This might be why average commutes for Roswell residents can last anywhere from 30-35 minutes each way. Nearly 80% of locals also depend on their own automobile for transportation, which means more cars on the road (and higher insurance premiums). Less than 5% carpool.

Has anybody ever said you could decrease your premiums by driving less? Well, it’s technically true, but hard to achieve any major savings. Even slashing your yearly mileage by 5,000 or even more is only going to lower premiums by about 4-5%.

- Your Coverage and Deductibles

Worried about our prime monthly premium of the comprehensive insurance plan? Well, you can test to reduce it by raising your deductibles. But do your favor and set just a little money aside, just just in case. In the end, who knows when you may have to file for claims.

- Education in Roswell, GA

For automobile insurance, the higher your education, the more likely it is that your provider will offer you a lower rate. This is good news for Roswell residents, because nearly 36% of the population has earned a bachelor’s degree. An additional 15% have at least a year of college experience.

There aren’t many local options for a four-year education in Roswell. Most residents prefer to commute to Atlanta to take advantage of the many universities located there. But if you’d rather keep your education local, you can look into the local University of Phoenix campus or Strayer University.

You mustn’t make it possible for an unsatisfactory insurance agency to persuade you into purchasing an automobile insurance policy that’s not ideal for you. Indeed, the level of related information required in order to guesstimate your own risk profile can be frustrating, however comparison internet websites like this might help make things easier. Simply submit just a few elements below, and then we shall do the rest.

How We Conducted Our Car Insurance Analysis

Sources:

Georgia Department of Law Consumer Protection Unit

Georgia Department of Human Services Office of Financial Services

Department of Highway Safety and Motor Vehicles

Get started comparing rates right now. It takes only a few minutes, and you can save a lot of money!