Cheap Auto Insurance in Atlanta, GA

Get the best Cheapest Car Insurance in Atlanta, GA? At CheapCarInsuranceinc.com, you can get the best insurance rates in your area. To receive free car insurance quotes from the top rated providers today, key your zip code into the quote box on this page.

Atlanta isn’t just the capital city of Georgia; it is also the most populous. The city is rich in both cultural diversity and finance-based business. Together with its agreeable climate and business-friendly environment, many agree that Atlanta is a great place to live. Learn more about Georgia car insurance requirements here.

- Fun fact:Did you know Atlanta is #7 on the list of “Top 50 cities with greatest precentage of males in occupations: Financial specialists: (population 50,000+)”? Learn more about Atlanta.

Coverage Requirements - Auto Insurance in Atlanta Georgia

If you want to drive legally in Georgia, you must purchase at least:

| Coverage | Requirements | Most Common |

| Liability Bodily Injury | 25,500/50,500 | 105,000/305,000 |

| Liability Property Damage | 30,000 | 60,000 |

| Bodily Injury - Motorist Uninsured | Not required | 30,000/55,000 |

| Not required Coverage | Medical Payments Coverage | 5,000 |

| Collision Coverage | Not required Coverage | 700 Insurance deductible |

| Comprehensive Coverage | Not required Insurance | 300 deductible |

However, keep in mind that liability insurance is extremely limited in what claims it will pay out. For theft, vandalism, or an accident that is the other driver’s fault, your insurance will not cover you.

The state average in Georgia can range around $183 per month, but rates in Atlanta can be as low as $49/mo* for many drivers. Depending on your personal circumstances, you can get great coverage for a low monthly rate, too.

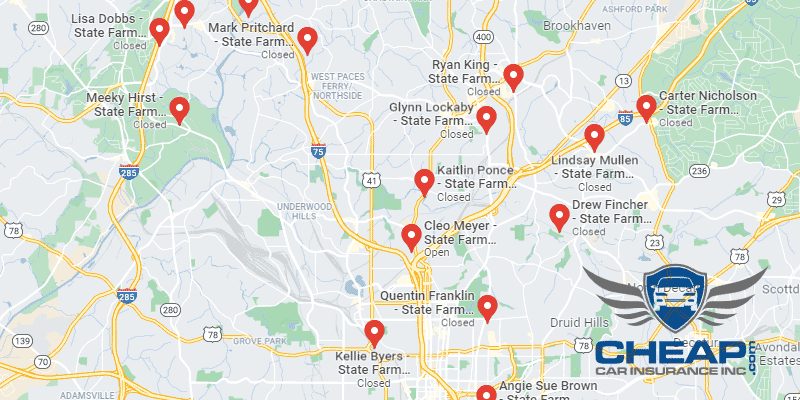

The Geico, Hartford, and Nationwide are competing to offer the lowest rates in Atlanta right now. But you have to pause and ask yourself what else they have to offer besides a low monthly premium. You’ll want a company with good customer service, and a claims service second to none. All in all, your monthly premium is only part of what you’re shopping for.

Auto insurance carriers consider different elements when calculating insurance quotes, including geography, zip code, marital status, occupation, and theft protection devices. In addition, premiums differ from provider to provider. To verify you’re still forking out the cheapest rate, compare cheap Atlanta auto insurance quotes online.

Most Car Insurance Facts to know in Atlanta GA

elements that many compaines take into account when creating an auto insurance policy. Regrettably, many of these elements are confusing or impossible to change, such as your credit score or where you live. Other variables your car insurance company may consider include:

- Your Zip Code

The cheapest car insurance is usually found in cities with a lower population density. Because there are fewer vehicles on the road, there are fewer possibilities for you to get into a major car accident with another driver. The population of Atlanta is 447,841 and the median household income is $46,485.

- Automobile Accidents

Anywhere with high accident statistics is going to cost more to insure your car. Regrettably, Atlanta has some pretty high Deadly accident statistics, as you can see from the chart above. You might want to talk to your insurer and see if they offer any safe driver discounts to counteract this.

- Car Thieving in Atlanta

Finding cheap auto insurance can be confusing if you are at risk for auto theft. Certain popular vehicle models are attractive to thieves, as well as vehicles which are parked often in large cities. The total number of stolen vehicles in Atlanta was 4,432 back in 2013. Did you know that the only form of insurance coverage which protects against auto theft is Comprehensive? It can be pricey, but it might be worth it in the long run if your car gets stolen.

- Your Credit Score

There are many things which are determined by your credit score – and, for better or for worse, car insurance is one of them. The better your score, the lower your monthly rate will be. Regrettably, motorists with poor credit are charged immensely higher rates, and the chart below shows.

- Your Age

Teenage motorists face a especially harrowing stress when forking out for their first auto insurance policy. Because of their inexperience, they are immensely more likely to get into a significant accident. That’s why some companies charge them 2x-3x higher premiums than someone twice their age.

- Your Driving Record

Having multiple violations on your record, or having significant violations such as Drunk Driving, will immensely raise your monthly rate. It may make you disqualified to get covered at all depending on the company. But if you only have one or two minor citations in the last few years, look into your provider’s “Accident Forgiveness” policy. Your provider will basically ignore a minor violation when calculating your premiums if you qualify.

- Your Vehicle

The thing most people don’t realize about insuring luxury cars is that it isn’t the vehicle itself that costs more to insure – it’s the numerous types of coverage (and in higher amounts) which you must purchase in order to protect your investment that raise the price tag, as you can see in the chart.

Minor Car Insurance elements in Atlanta

- Your Marital Status

- Your Gender

Are you afraid you’ll be forced to pay higher rates because you’re female, or because you’re male? Odds are that you won’t have to worry that much. Many providers these days don’t charge different rates based on gender at all. And those who do might only charge 1-2%.

- Your Driving Distance to Work

While most work commutes can average 17-31 minutes for Atlanta residents, it isn’t unusual for the commute to last up to 35 minutes. About 65% of workers take their own automobile to work, whereas another 11% either carpool or take the bus.

Some insurers want to make a big deal out of how many miles you drive yearly, or why you’re driving (work/school vs. recreation). But in truth, unless you’re driving a business vehicle (which can see rate hikes as high as 10%) or more, your reason or distance won’t drastically alter your rate.

- Your Coverage and Deductibles

Most auto insurance providers offer some flexibility when it comes to your policy. For example, you can reduce your monthly payments and increase your coverage by asking to raise your deductible. Yes, it may make repairs or replacements more expensive, but you can save up the extra money with lower payments.

- Education in Atlanta, GA

There are many different universities and technical schools to choose from in the Atlanta area. There are nearly 50 schools which offer either bachelor’s or graduate degrees in a wide range of fields, from business to medicine to liberal arts. Additionally, the Atlanta Technical College educates its students in more than seventy different specialized trades.

Regrettably for most insurance companies, a simple internet search can reveal many of their trade secrets. But even with the proper information, it can still be confusing for you as an individual to figure out your risk profile and find low-cost insurance. Make sure you do your due diligence before you commit to your next car insurance policy.

How We Conducted Our Car Insurance Analysis

Sources:

Georgia Department of Law Consumer Protection Unit

Georgia Department of Human Services Office of Financial Services

Department of Highway Safety and Motor Vehicles

Ready to Compare Rates and Purchase Your Coverage? Enter Your State Below To Get Started!