Cheap Auto Insurance in Savannah, GA

Are you looking for cheap auto insurance in Savannah, GA? At CheapCarInsuranceinc.com, you’ll find the very best insurance rates where you live. To find free car insurance quotes from the very best providers today, provide your zip code into the quote box on this page.

Savannah is quickly growing into a #1 destination for both tourism and retirees. It has an agreeable climate, years of historical culture, and generous amounts of architectural and natural beauty. It is an old southern town with metropolitan flare, and even rated one of the most attractive cities in the United States by international publications.

- Fun fact: Did you know that Savannah is #5 on the list of “Top 101 cities with the largest percentage of people in military barracks, etc. (population 50,000+)”? Learn more about Savannah.

Coverage Requirements - Auto Insurance in Savannah Georgia

For legal driving in Georgia, you will need to purchase:

| Coverage | Requirements | Most Common |

| Liability Bodily Injury | 25,500/50,500 | 105,000/305,000 |

| Liability Property Damage | 30,000 | 60,000 |

| Bodily Injury - Motorist Uninsured | Not required | 30,000/55,000 |

| Not required Coverage | Medical Payments Coverage | 5,000 |

| Collision Coverage | Not required Coverage | 700 Insurance deductible |

| Comprehensive Coverage | Not required Insurance | 300 deductible |

Remember that Liability coverage only pays out on claims if the incident in question was something you caused (or found liable for). For any other situation, you will be financially responsible for your vehicle. And if you are currently financing your automobile, your lender may require additional coverage regardless of legal minimums.

Georgia insurance averages can be a little high – some studies show that the average driver is forking out somewhere around $183 per month for basic coverage. However, you can get covered in Savannah for as little as $42/mo* while still maintaining good coverage on your vehicle.

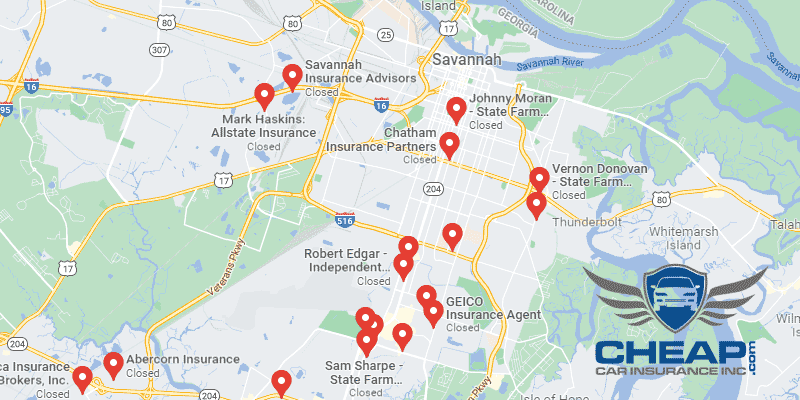

As you can see, Nationwide, The Geico, and Allied have some of the lowest rates around Savannah. But insurance isn’t all about premiums. Customer service is important, as well as the claims filing process. Make sure you do your research and find the company that’s right for you.

Auto insurance providers consider various elements when figuring out insurance quotes, including driving violations, accident claims, occupation, miles driven each year, and business use of the vehicle. Likewise, premiums change from provider to provider. To make sure you’re still being charged the most favorable rate, compare rates and learn more about car insurance in Georgia here.

Most Car Insurance Facts to know in Savannah GA

There are numerous ways your car insurance rate can be estimated. But not all of it is out of your control; there are actions you can take so that you can impact which discounts you are eligible to obtain. Listed here are some of these components in greater detail:

- Your Zip Code

Where you park your car each night will have a major impact on your auto insurance rate. Generally, car insurance is cheaper in rural areas because fewer cars means a smaller chance that you will get into a collision with another vehicle. The population of Savannah is 142,772 and the median household income is $36,198.

- Automobile Accidents

Savannah has a higher per capita accident Deadlyity rate than other cities in Georgia with a similarly-sized population. These alarming statistics may end up raising your insurance premiums. Talk to your local agent, and see if there are Safe Driver discounts available near you.

- Car Thieving in Savannah

Even in small cities or rural towns, auto theft can still be a problem. In order to make it less of a problem for you, think about installing a passive anti-theft system on your car. Your auto insurance company may reward you with lower rates! In Savannah, there were 725 Car Thieving in 2013. Keep in mind that, although pricey, Comprehensive coverage is the only type of insurance coverage which will pay out on theft claims.

- Your Credit Score

It’s hard to make sure you have a good credit score – regardless, Automobile insurance companies still use this metric as a way to determine what to charge you each month for your coverage. And, as you can see, it can make a big difference.

- Your Age

In the market to insure a teenage driver? Well, we have some bad news, and some good news. The bad news is that teenage drivers are the most expensive drivers to insure (on account of their lack of driving experience and increased accident risk). The good news is that there are discounts specifically for teenagers – such as “Good Student” and Driver’s Ed discounts – which can help alleviate the financial stress.

- Your Driving Record

If you can keep a clean driving record, you can secure the lowest possible rate on your Automobile insurance policy. Regrettably, the more violations you add to your record, the more expensive your insurance will become. You may even lose your coverage completely depending on your provider, and the severity of the violations.

- Your Vehicle

If you have a common, inexpensive car, it will be much easier to fix or replace should the worst happen than an expensive, luxury vehicle. And an inexpensive car doesn’t require an extensive, comprehensive insurance policy.

Minor Car Insurance elements in Savannah

- Your Marital Status

It’s not that being married makes you more or less likely to get into an accident, statistically speaking. However, insurance companies love it when you bundle policies together. Spouses are in a great position to save by giving their insurance company what they want and bundling their policies. You can even bundle homeowners, renters, or other forms of insurance (as long as all policies are offered by your insurer).

- Your Gender

Did you ever really believe that there was a significant difference between one gender or another when it came to driving? Well, as it turns out, neither do most insurance companies these days. multiple providers charge the same premium, if the only real difference is gender. Others may charge 2-3% more for one gender over another, and it isn’t always the gender you think it is.

- Your Driving Distance to Work

It can take anywhere from 14-21 minutes for most drivers in Savannah to make it to work each day. Of those, depending on which part of the city you live in, anywhere from 3% to 23% will carpool on a given day.

If you can help it, try to avoid registering your car as a business vehicle. On average, those vehicles get charged 10-12% higher rates than vehicles driven for work, school, or even recreationally. Also, yearly mileage is a fairly negligible factor – whether your drive above or below the national average, you may only see a 2-3% fluctuation in your rate.

- Your Coverage and Deductibles

If you want to add coverage to your policy but still receive a discounted rate, try raising your deductible. In the event that the worst happens, your out of pocket expenses will be higher, but the lower monthly premiums should help you save up for a rainy day.

- Education in Savannah, GA

The largest percentage of drivers in Savannah has obtained a high school diploma. A smaller amount has yet to complete their high school education. But did you know that going back to school can get you a lower price on car insurance? It’s true! Insurance providers tend to give lower rates to those who have bachelor’s degrees, regardless of job or salary.

If you’re looking to improve upon your education in Savannah, you’re in luck: there are multiple different schools with all types of specializations for you to choose from. Two major universities, Savannah State University and Armstrong Atlantic State University, offer almost 100 different degrees to more than 9,000 students annually. Savannah is also home to one of the biggest art/design universities in the US, known as the Savannah College of Art and Design.

Determining your individual financial risk can be very confusing or impossible for the typical insurance shopper. Insurance companies have an advantage over consumers due to their statistics and experiential knowledge. Learn what insurance companies don’t want you to know.

How We Conducted Our Car Insurance Analysis

Sources:

Georgia Department of Law Consumer Protection Unit

Georgia Department of Human Services Office of Financial Services

Department of Highway Safety and Motor Vehicles

Find Low Cost Auto Insurance Policies in Savannah, Georgia – See How Much You Can Save, Compare Coverages